Loading ...

Loading ...

Trading 0DTE options without proper exit strategies is like driving without brakes. A trailing stop can protect your profits while letting winning trades run — and now you can backtest this strategy visually without any coding using GreeksLab.

In this comprehensive guide, we'll walk you through setting up, backtesting, and optimizing a trailing stop strategy that could significantly improve your 0DTE options trading performance.

Don't have time to watch? Follow the step-by-step guide below.

A trailing stop is a dynamic exit mechanism that automatically adjusts your stop-loss level as your trade moves into profit. Unlike a fixed stop-loss, it "trails" behind the maximum profit achieved, protecting gains while allowing room for continued upside.

Zero Days to Expiration (0DTE) options are particularly volatile, with profit windows that can disappear within minutes. Traditional fixed profit targets often leave money on the table, while trailing stops adapt to market movement in real-time.

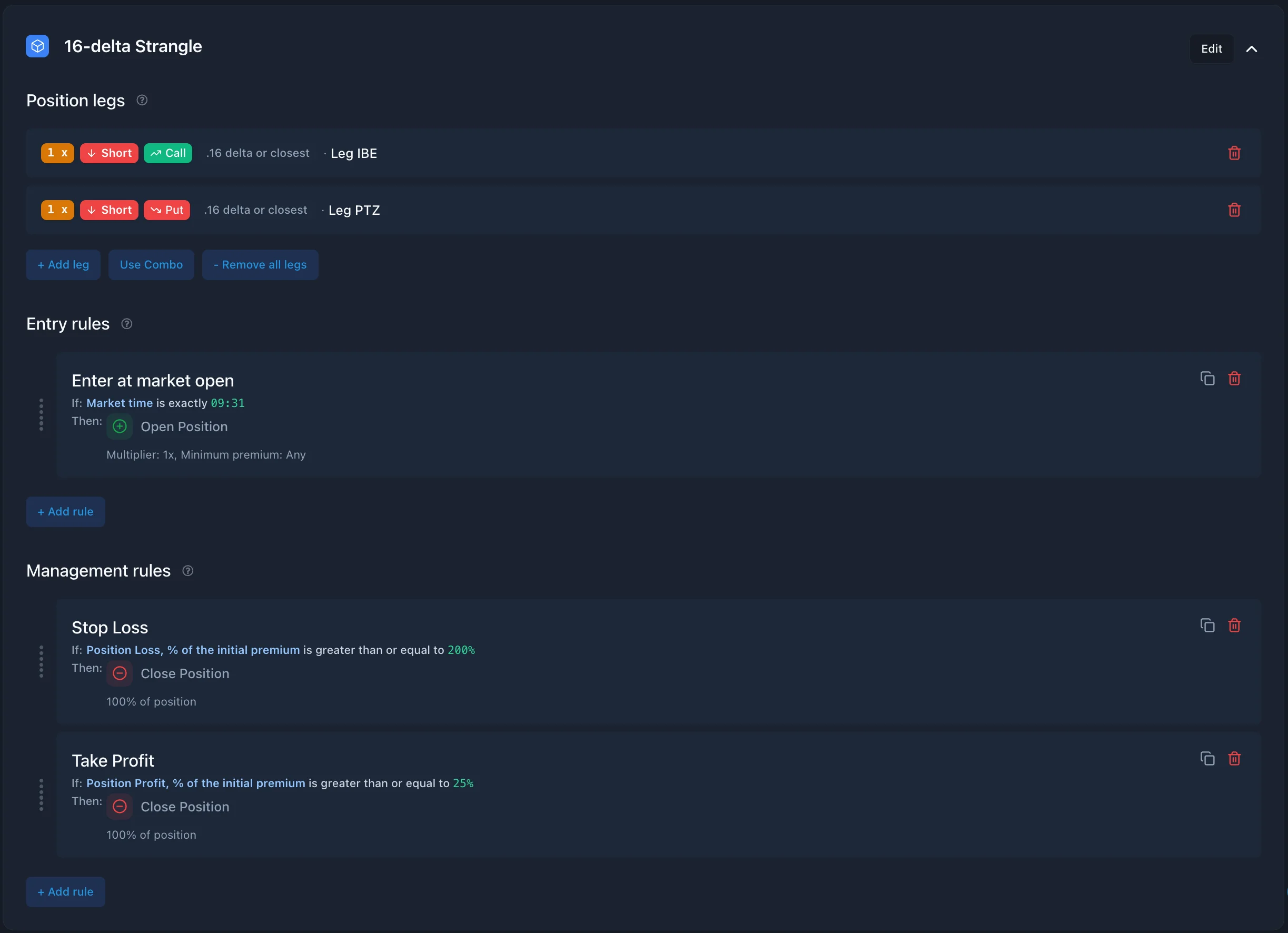

Before adding a trailing stop, establish a baseline strategy to measure improvement against.

Run this baseline backtest first to establish your performance metrics. Record key statistics like:

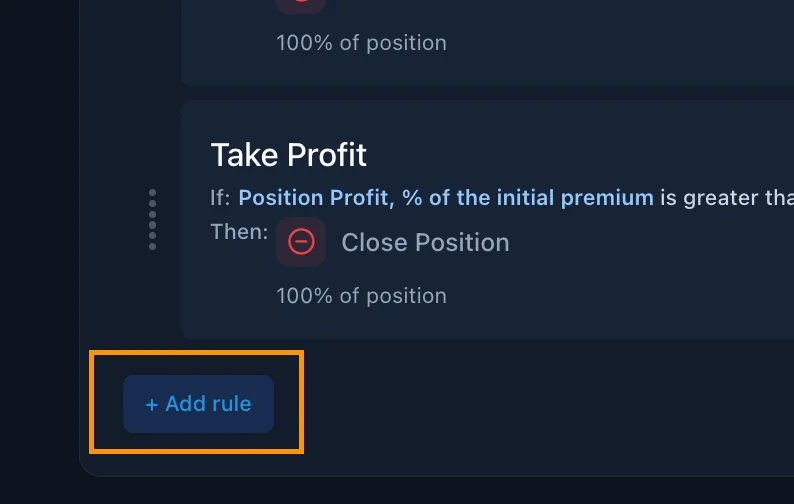

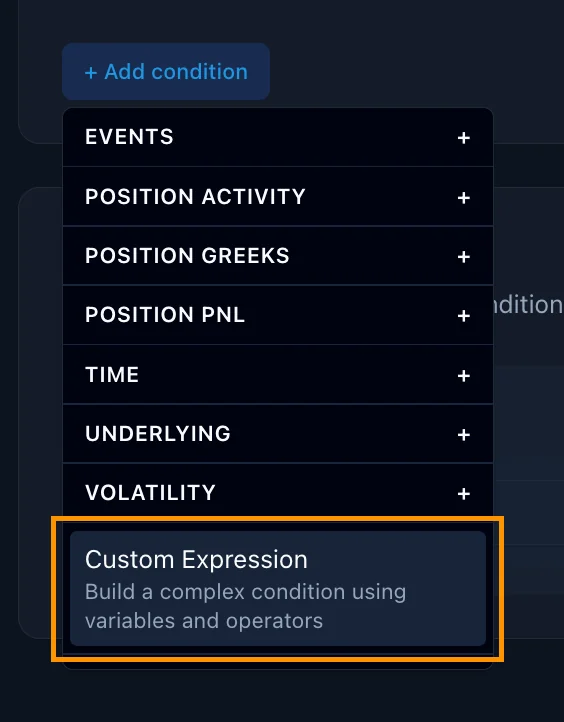

GreeksLab's visual rule builder makes implementing complex exit strategies simple. Here's how to add a trailing stop to your existing strategy:

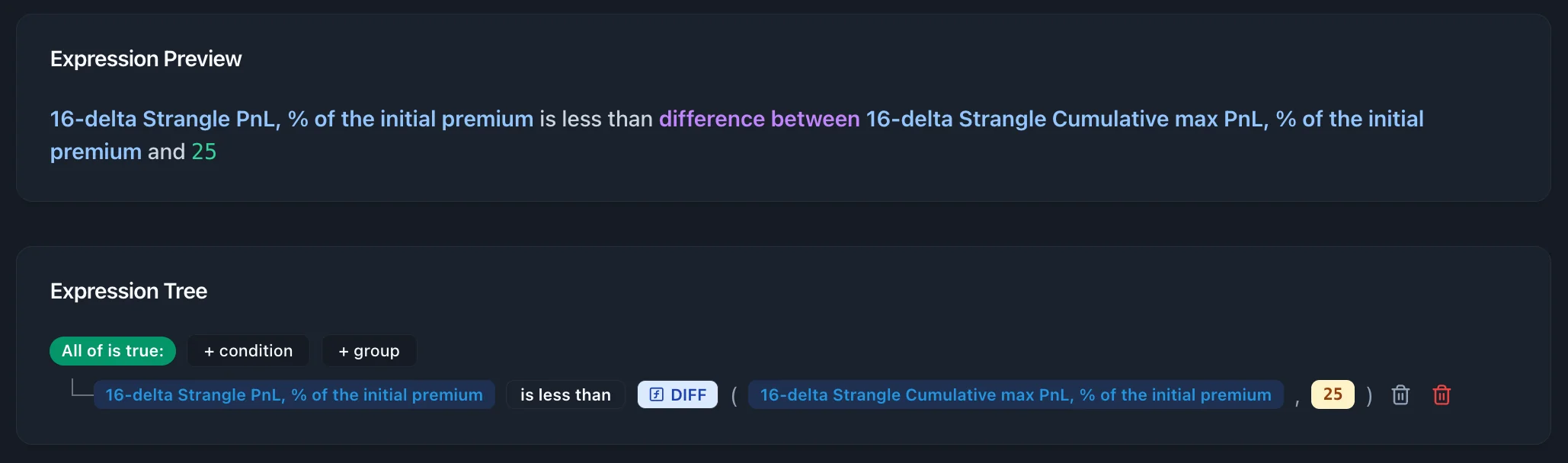

Using GreeksLab's Custom Expression builder:

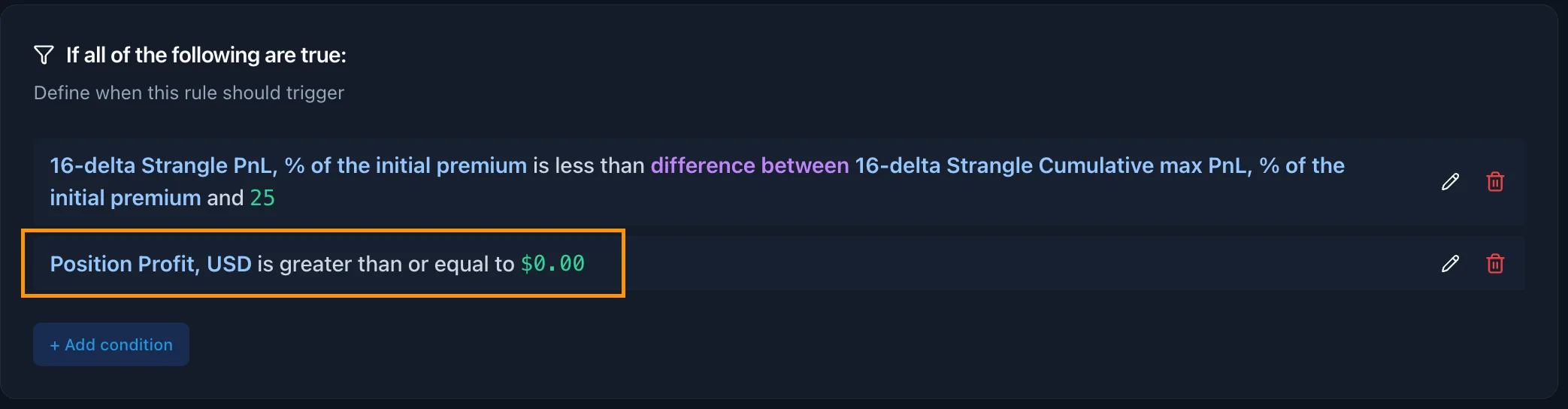

Primary Condition: Profit Drawdown Check

Secondary Condition: Profitability Check

As an example, we will add a secondary condition: we want our trailing stop to simulate only when position is profitable.

This creates a rule that says: "Close the position if current profit has dropped 25 percentage points from its peak, but only if the trade is still profitable overall."

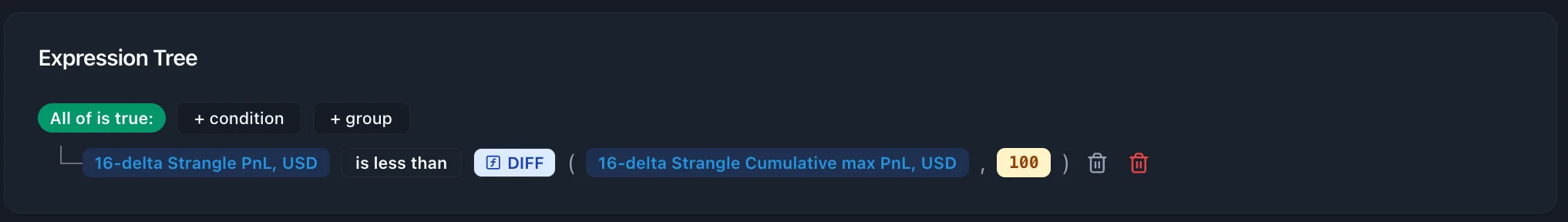

For strategies with high premiums, consider absolute dollar values:

Primary Condition:

This approach works well for strategies where percentage moves might be too sensitive.

Add time conditions to prevent early exits:

Modify trailing distance based on VIX levels:

Create tiered trailing stops:

Compare your trailing stop results against the baseline:

Performance Metrics:

Risk Metrics:

Most traders see improvements in:

Test different trailing stop distances to find your sweet spot:

Tight Trails (10-15 points):

Moderate Trails (20-30 points):

Wide Trails (35+ points):

Adapt trailing distances based on market environment:

Don't create overly complex rules based on limited backtesting data. Simple, robust strategies often outperform in live trading.

Factor in commissions and bid-ask spreads when setting trail distances. Very tight trails might eat into profits through excessive trading.

Backtest across various market environments:

Before risking real capital, paper trade your trailing stop strategy for at least 30 days to:

Review and potentially adjust quarterly, but avoid constant tweaking. Stable parameters often perform better than frequently changed ones.

Yes, combine trailing stops with:

Trailing stops represent a significant evolution in options trading risk management. By letting profits run while protecting against reversals, they solve one of the biggest challenges in 0DTE trading: knowing when to exit.

GreeksLab's visual rule builder makes implementing these sophisticated strategies accessible to every trader, regardless of coding experience. The combination of powerful backtesting capabilities and intuitive design creates the perfect environment for strategy development and refinement.

Start small, test thoroughly, and gradually increase position sizes as you gain confidence in your trailing stop parameters. Remember, even a modest improvement in exit timing can significantly impact your overall trading performance.

The difference between good traders and great traders often comes down to discipline and systematic approach to exits. Trailing stops provide both — turning emotional decisions into data-driven rules that work even when you're not watching the screen.

Ready to backtest your first trailing stop strategy? Start your free GreeksLab trial today and see how dynamic exits can transform your 0DTE options trading results.

Create a free account or sign in to access: