Loading ...

Loading ...

Zero‑day (0DTE) SPX options have exploded from niche curiosity to headline phenomenon. Industry data shows that more than half of all SPX option contracts now trade on their expiration day — a dramatic shift driven by:

For active traders, 0DTE presents a unique mix of speed, flexibility, and well‑defined risk. For newcomers, it also carries sharp hazards. The rest of this guide unpacks both sides — and shows how to test ideas safely before real money is at stake.

These quirks compress theta, gamma, and implied‑volatility shifts into a handful of hours. Profits (and mistakes) happen fast.

Because of the compressed time frame, theta decay, volatility shifts, and gamma exposure are concentrated into just a few hours—creating both opportunity and risk.

Take‑away: 0DTE shines for disciplined, rules‑based traders who crave rapid iterations. If you prefer a calmer tempo, stick to multi‑day options.

GreeksLab is a backtesting platform for SPX 0DTE strategies, allowing you to test trade ideas on historical intraday data at one-minute resolution—no coding required.

Choose a preset (spread, condor, straddle, strangle) or build legs manually. For each leg you can target by:

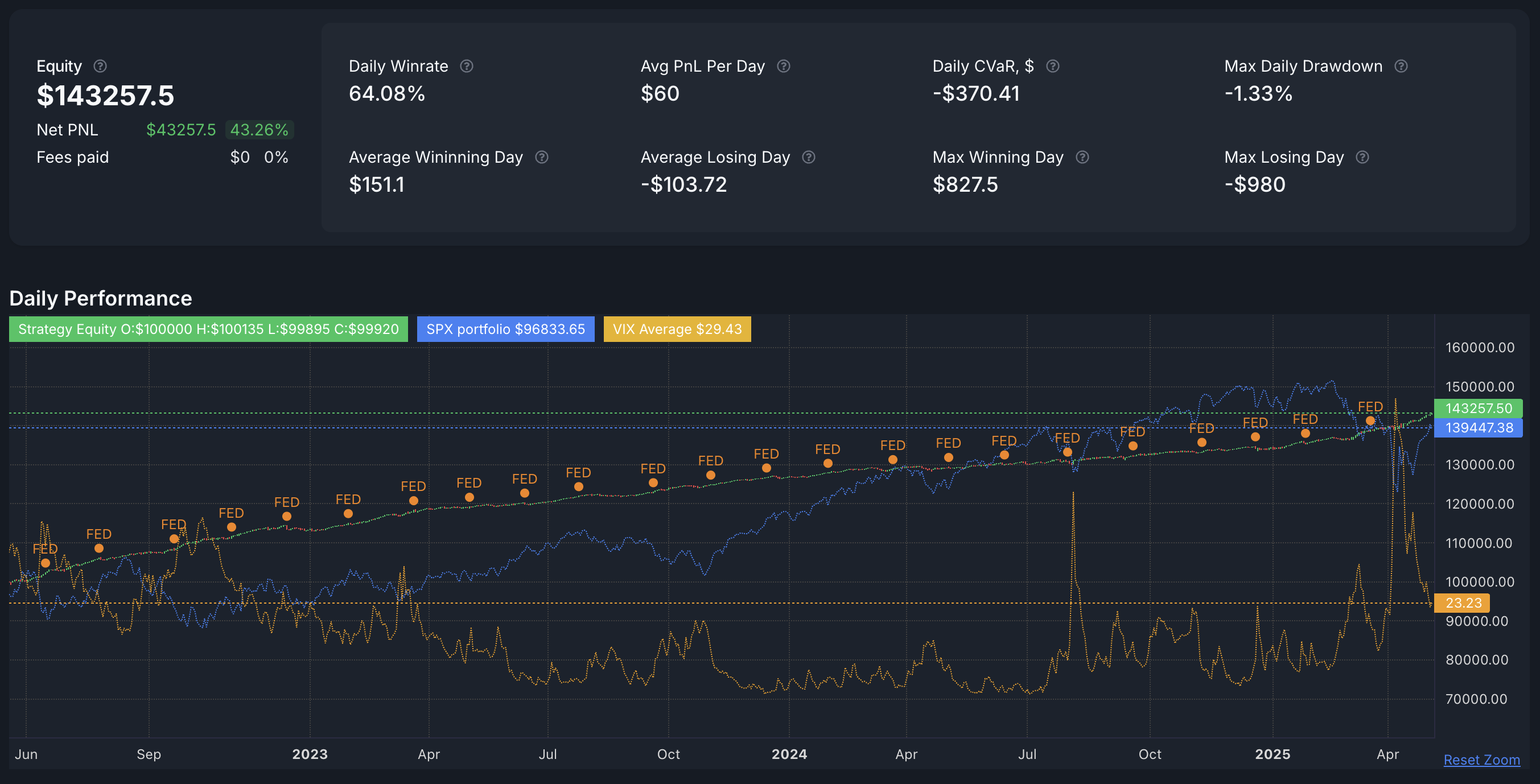

Pick a date range (e.g., last 12 months). GreeksLab re‑creates every eligible day at one‑minute granularity, logs each fill, and outputs:

Backtesting helps you refine timing, structure, and logic by observing how your approach behaved under actual market conditions.

Backtesting isn’t about predicting the future — it’s about understanding how your logic would have worked in the past.

GreeksLab helps you:

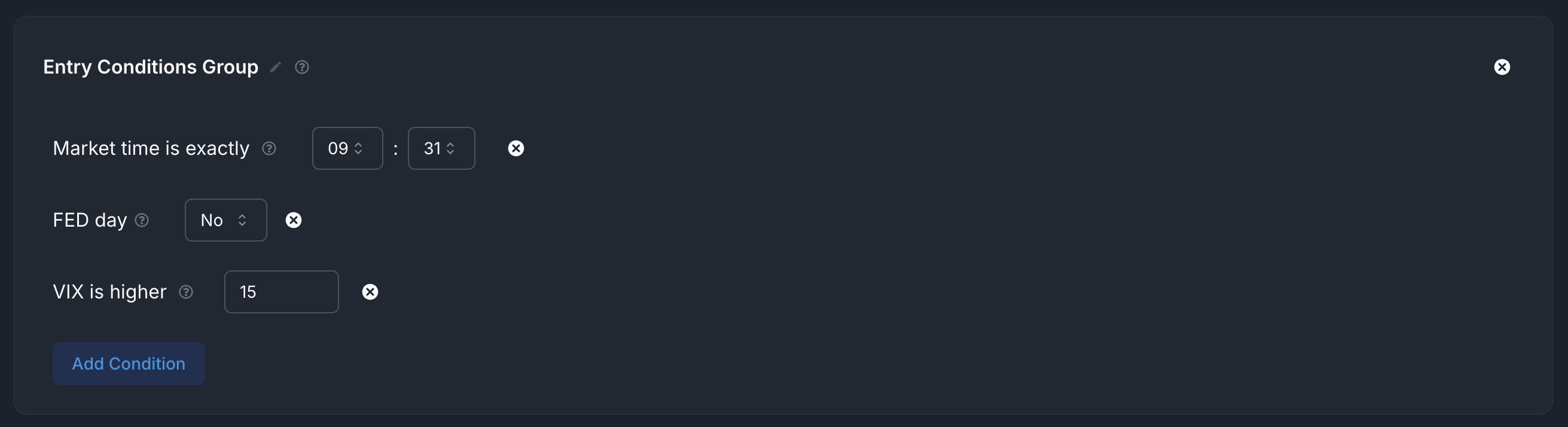

Test entry timing (e.g. avoid first 30 minutes after open)

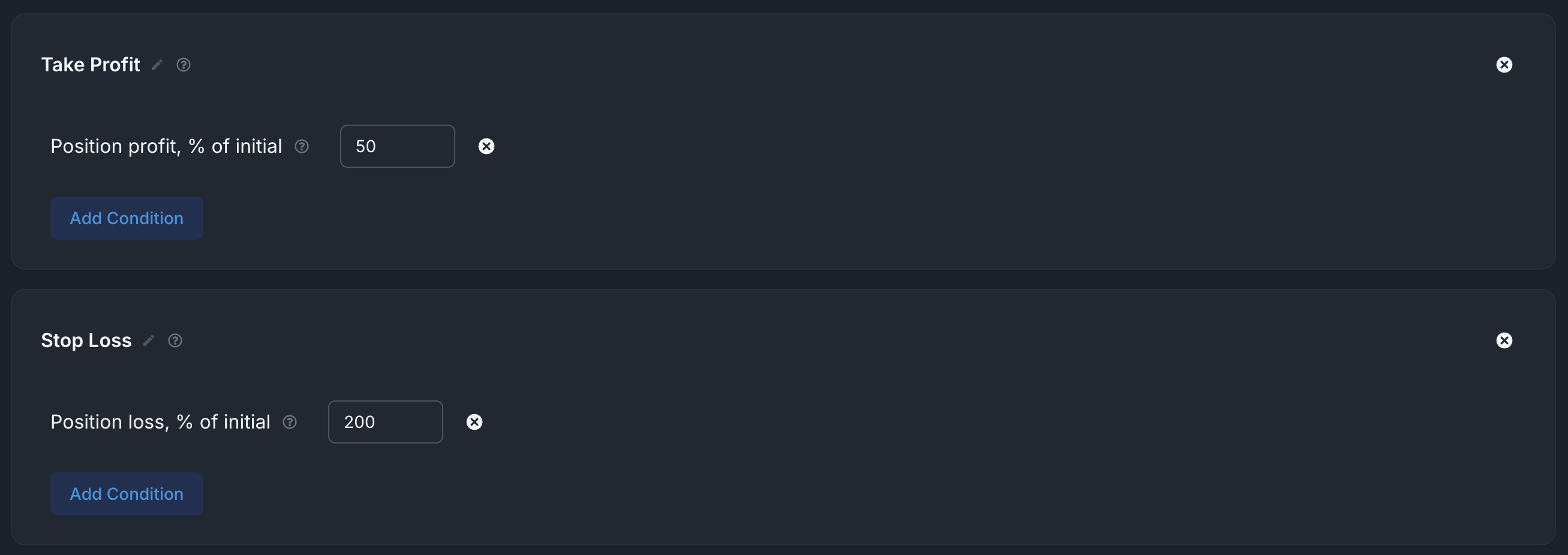

Set and evaluate exit logic (profit targets, stop-loss, time-based exits)

Filter for context (e.g. skip days with VIX spikes or macroeconomic news)

This helps you build confidence—or identify flaws—before deploying real capital elsewhere.

📌 Backtesting does not guarantee future results, but it’s essential for developing a data-driven strategy.

No exit plan: Letting trades run until expiration increases risk.

Oversizing: Losses on 0DTE trades can escalate quickly. Keep risk per trade controlled.

Ignoring context: Avoid trading during high-impact events like CPI, FOMC, or large earnings days.

Overfitting: Don’t add excessive conditions just to make backtests look good. Simpler rules often perform better in live conditions.

0DTE can be powerful—but only with consistent rules, measured risk, and an adaptive mindset.

0DTE SPX trading is fast-paced and data-sensitive. With the right tools, you can turn this into a structured, testable process—not a guessing game.

GreeksLab enables you to:

Build and test trade ideas using real SPX data

Validate your setups across different market regimes

Learn what works—before risking capital

Create a free account or sign in to access: