Loading ...

Loading ...

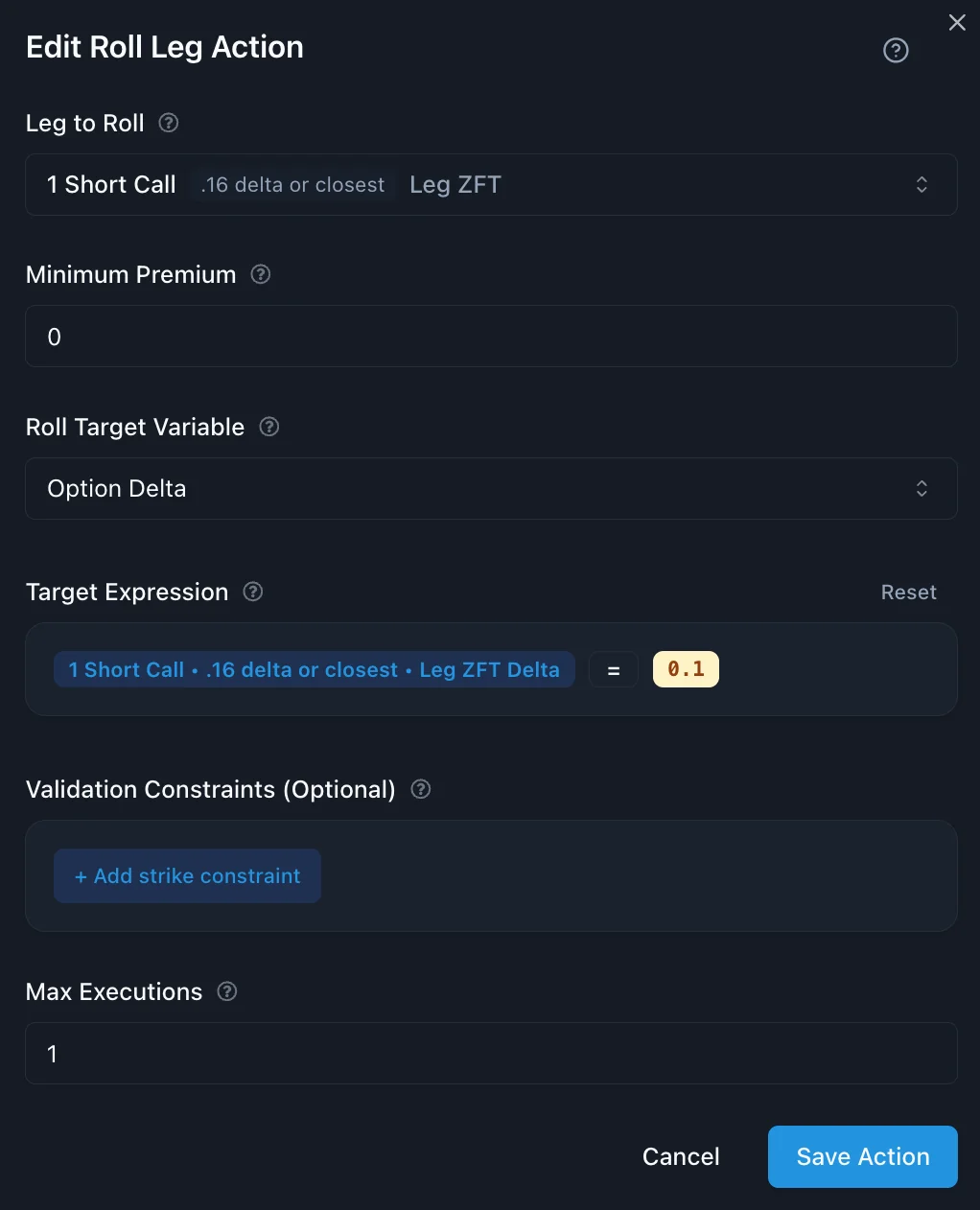

Simulate dynamic position adjustments by rolling individual option legs

The Roll Leg action is the most sophisticated position management tool in GreeksLab, allowing you to adjust existing position legs by changing strikes. This advanced action enables dynamic position management that can adapt to changing market conditions.

Rolling involves closing an existing position leg and simultaneously opening a new leg with a different strike price. This creates a seamless transition that maintains your position structure while adjusting to market movement.

Choose which leg in your position template you want to roll. Each leg is displayed by its name to help you identify the correct one.

Set the minimum premium per option contract (in dollars) that you want to collect when rolling the leg. This ensures you collect enough premium to justify the roll.

Choose what you want to control when rolling the leg. This will be the variable that the system solves for in your target expression:

Create an expression that defines your rolling goal. The system will solve for the target variable value that makes your expression true, then roll to the closest matching option.

Validation constraints prevent unwanted situations by checking leg strike relationships after the roll, such as preventing inversions where call strikes end up below put strikes.

Maximum number of times this roll action can be executed during the lifetime of the position.

Master the Roll Leg action with these resources: