Loading ...

Loading ...

Learn about the different actions that can be taken when conditions are met

Actions define what happens when your rule conditions are satisfied. GreeksLab provides four powerful actions that give you complete control over position management throughout the trading lifecycle.

Actions are the "THEN" part of your rule logic. When all conditions in a rule are met, the specified action executes automatically during backtesting.

Action Formula: IF (conditions are met) THEN (execute action)

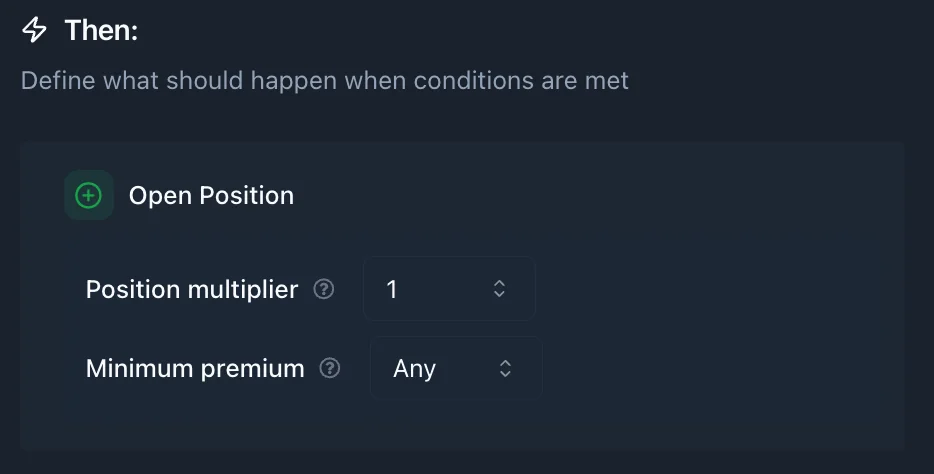

Purpose: Creates a new position based on your position template

When to Use:

How It Works:

Parameters:

Best Practices:

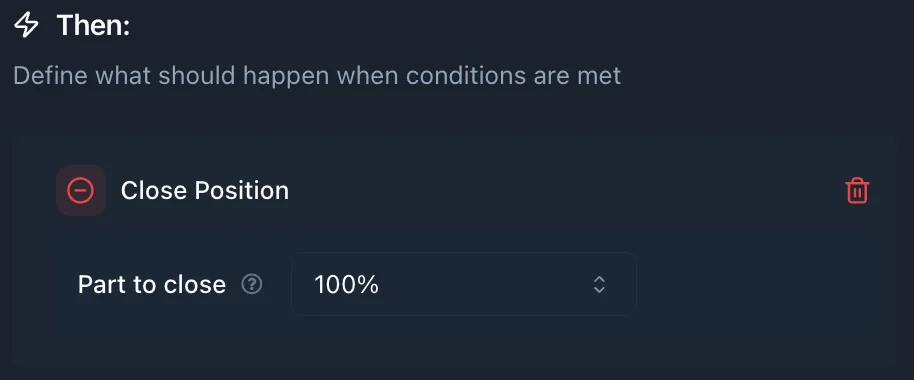

Purpose: Exits an entire existing position by closing all legs

When to Use:

How It Works:

Parameters:

Best Practices:

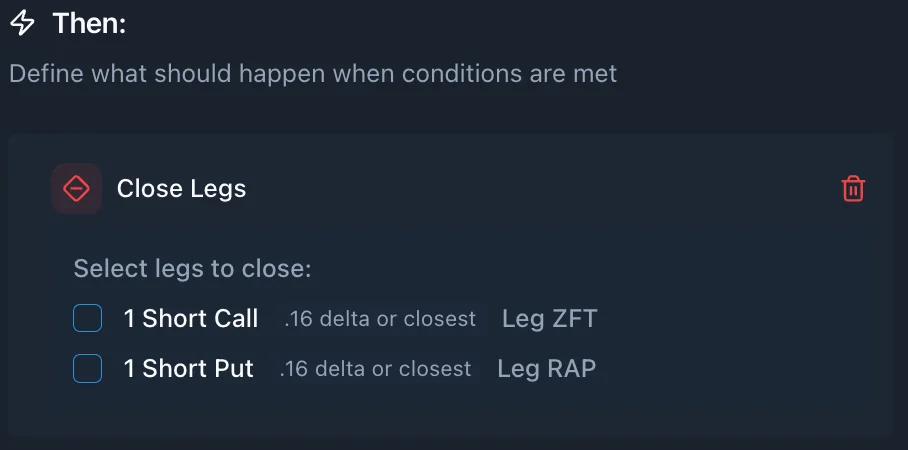

Purpose: Selectively closes specific legs of a multi-leg position

When to Use:

How It Works:

Best Practices:

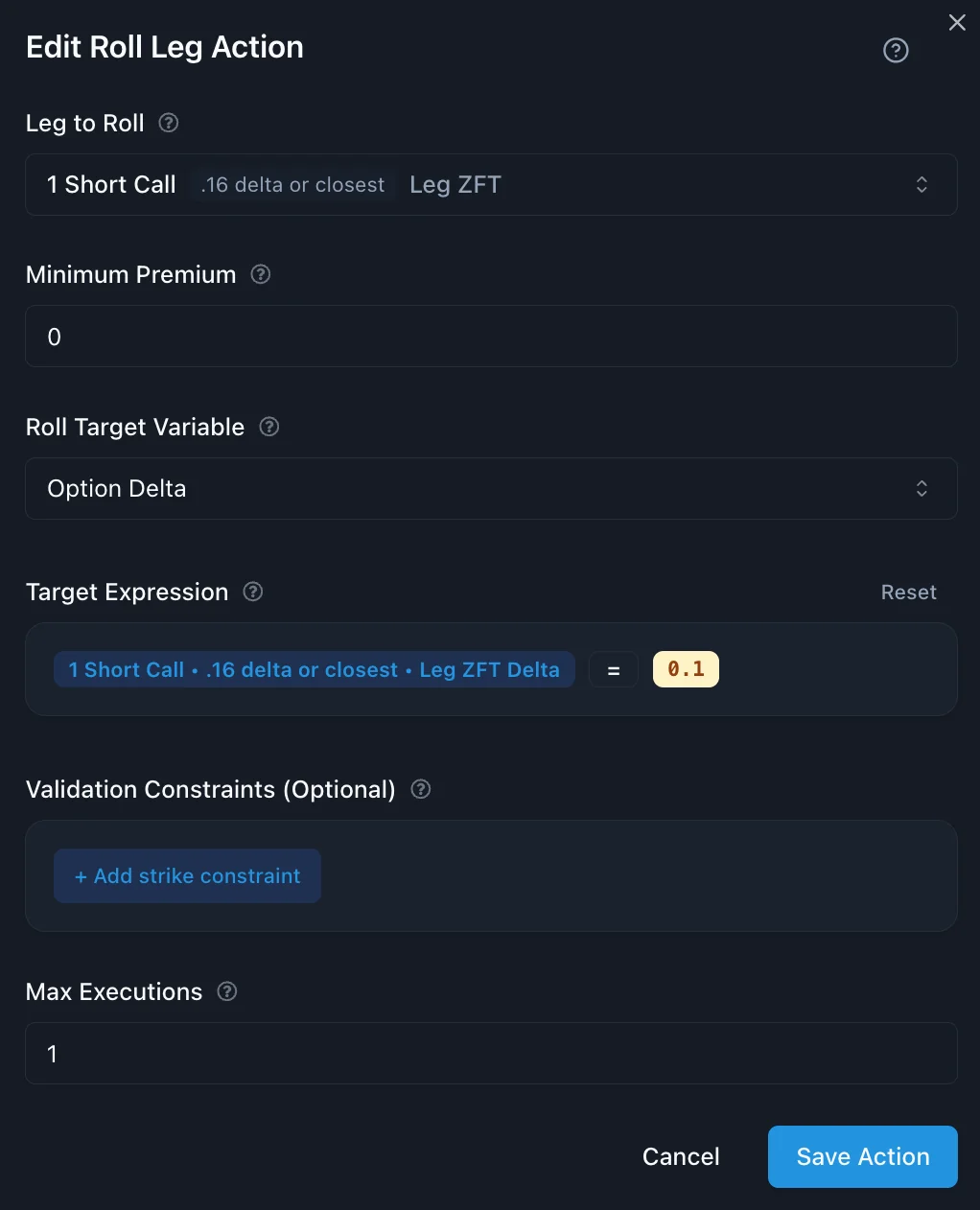

Purpose: Adjusts a specific position leg to a new strike

When to Use:

Overview: Roll Leg is the most advanced action, allowing you to modify existing position legs rather than simply opening or closing them.

Common Roll Scenarios:

Basic Parameters:

Ready to implement specific actions? Explore these detailed guides:

Or return to the Strategy Building Guide to see how actions fit into your complete trading strategy.