Backtest Comparison & Portfolio Combination

Compare multiple backtests side-by-side and combine them into weighted portfolios to analyze diversification benefits and portfolio performance.

Overview

The comparison tool helps you:

- Evaluate variants - Compare different strategy configurations

- Find diversification - Analyze correlation between strategies

- Build portfolios - Combine backtests with custom weights

- Optimize allocation - Test different weight distributions

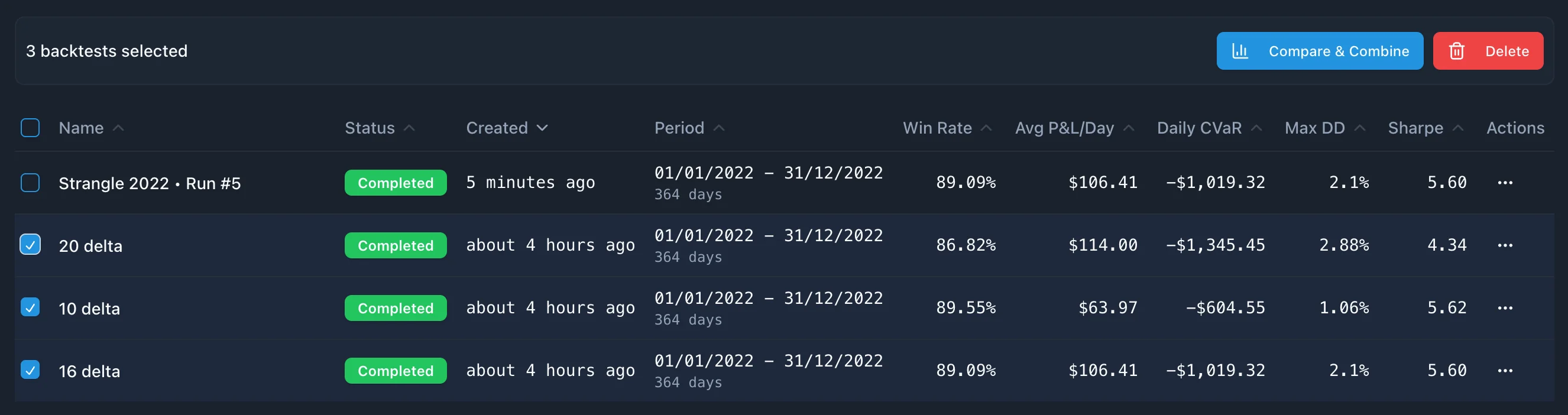

Starting a Comparison

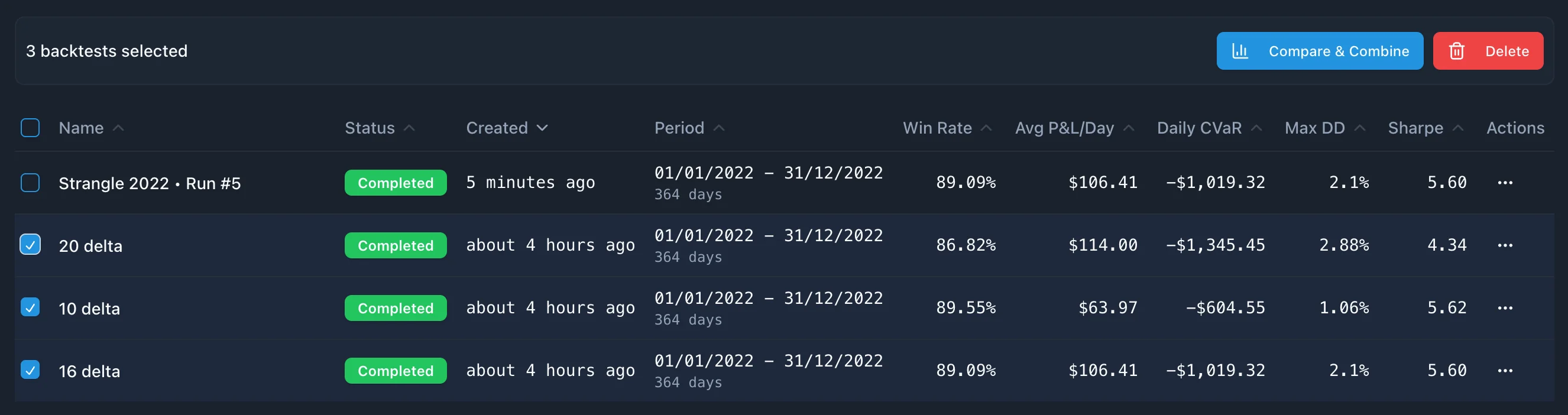

From Backtests List

- Select 2-10 backtests using checkboxes

- Click "Compare & Combine" button

- Comparison page opens with your selected backtests

Requirements

- Minimum: 2 backtests

- Maximum: 10 backtests

- Status: Only completed backtests can be compared

Comparison View

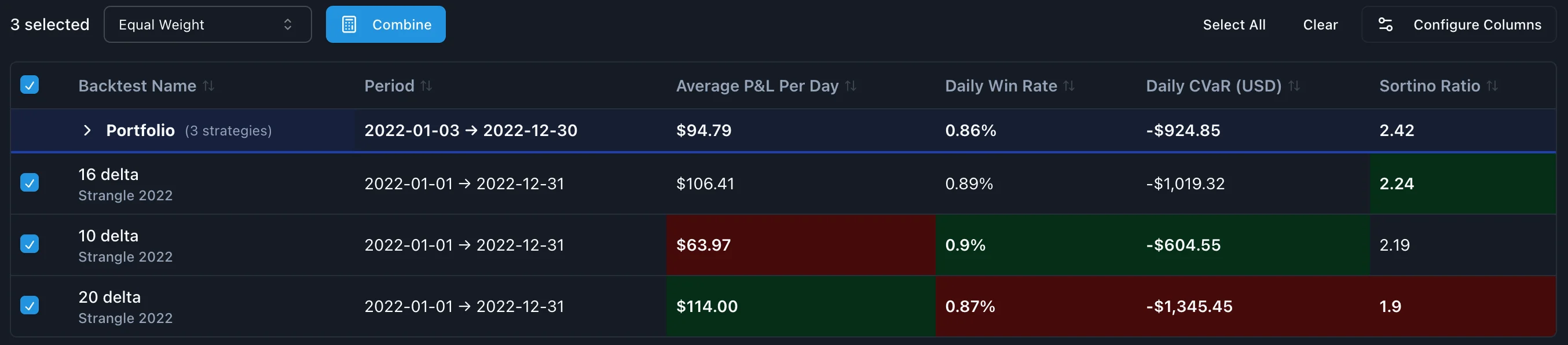

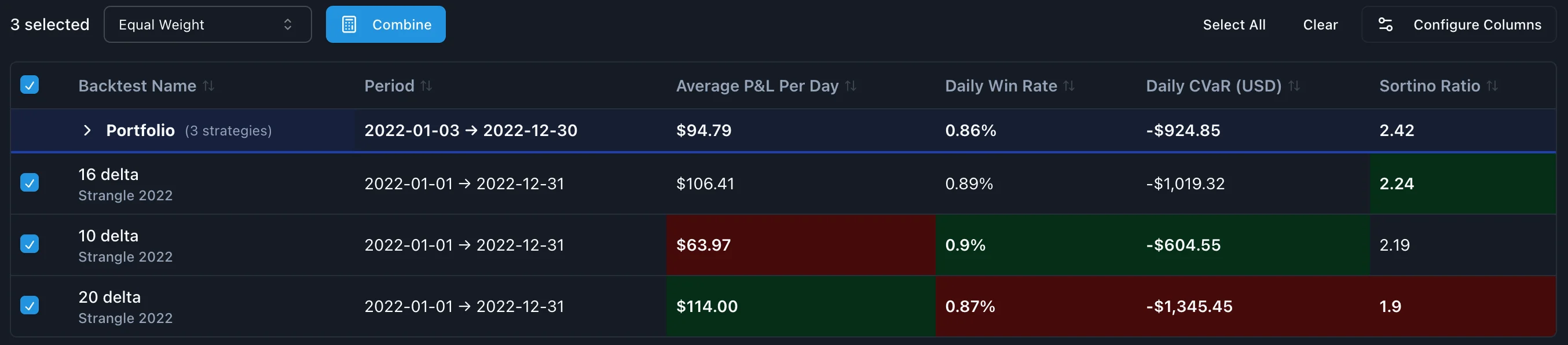

Metrics Table

The comparison table shows key performance metrics side-by-side for easy comparison:

Customizable Columns:

- Click "Configure Columns" to select which metrics to display

- Choose from all available backtest metrics

- Default view: Average P&L per day, Win rate, CVaR, Sortino ratio

- Customize to focus on metrics most relevant to your analysis

Visual Features:

- 🟢 Green background = Best performing value in that column

- 🔴 Red background = Worst performing value in that column

- Sortable columns - Click header to sort (asc → desc → reset)

- Sticky name column - Remains visible when scrolling horizontally

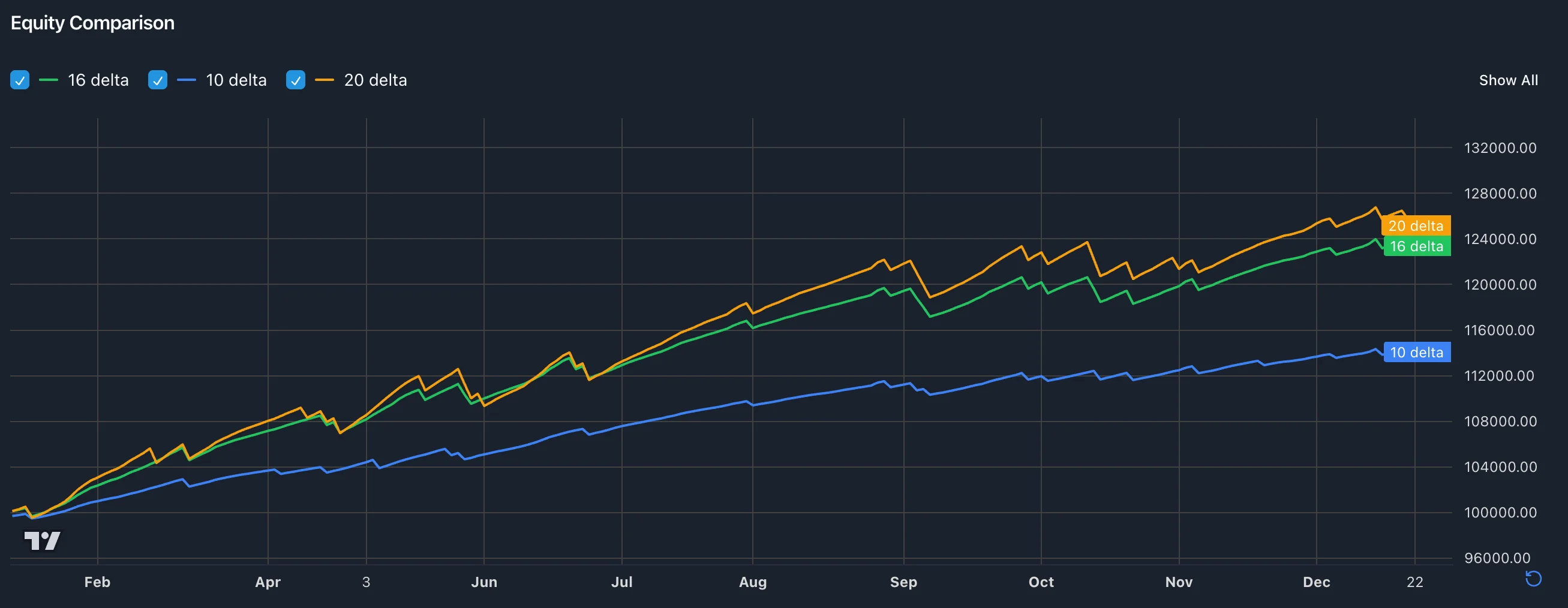

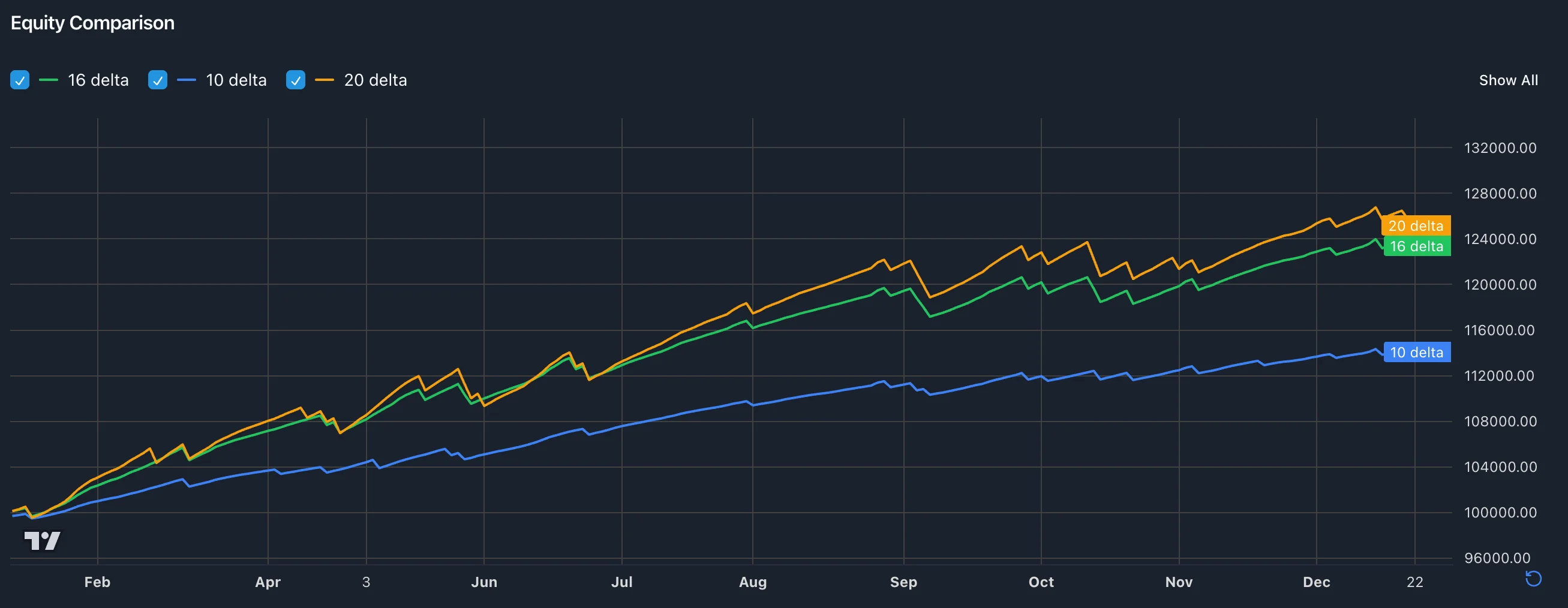

Equity Curves

Visualize all equity curves on a single chart:

- Overlay view - All curves on one chart

- Toggle visibility - Show/hide individual curves

- Zoom & pan - Examine specific periods

- Legend - Click to toggle curves on/off

Identify:

- Which strategies perform better in different market conditions

- Drawdown periods across strategies

- Recovery patterns and consistency

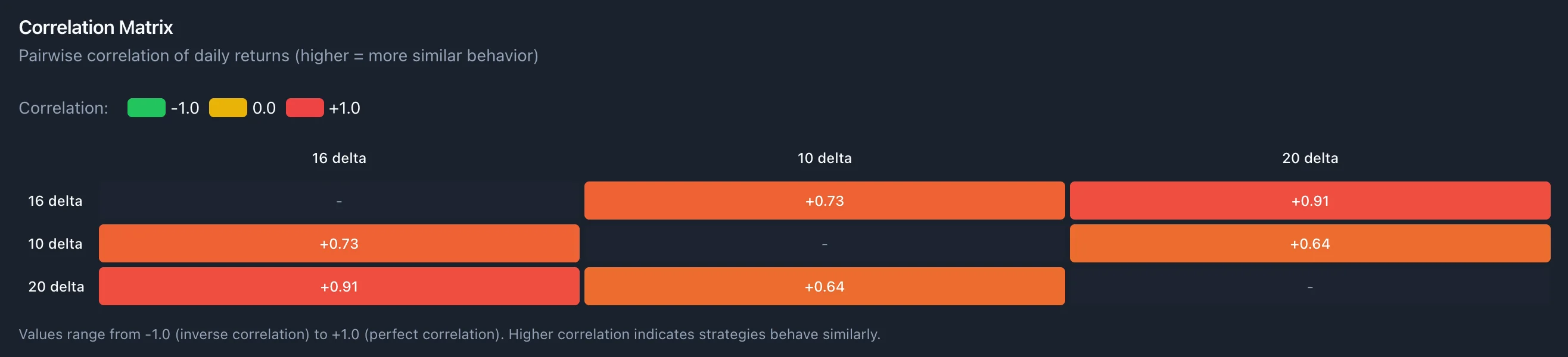

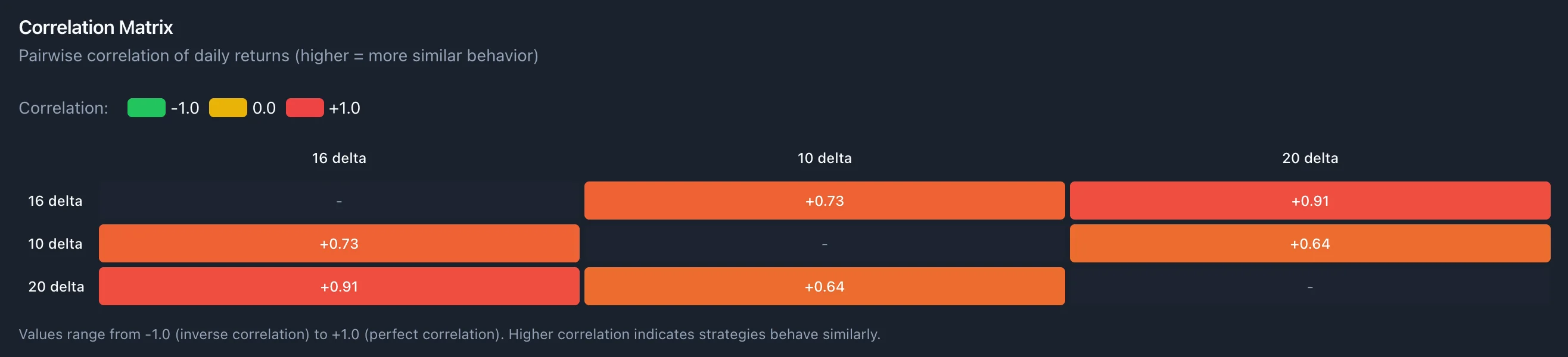

Correlation Matrix

Understand how strategies move together:

Interpretation:

- +1.0 = Perfect positive correlation (move together)

- 0.0 = No correlation (independent)

- -1.0 = Perfect negative correlation (move opposite)

Color Scale:

- 🔴 Red (high correlation) - Limited diversification

- 🟡 Yellow (moderate) - Some diversification benefit

- 🟢 Green (low/negative) - Excellent diversification

Minimum Data: Requires 30+ overlapping trading days between backtests.

Finding Good Diversification:

- Look for correlation < 0.5

- Negative correlation provides hedging benefits

- High correlation (>0.8) offers minimal diversification

Portfolio Combination

Combine backtests into a weighted portfolio to:

- Test diversification benefits

- Optimize risk-adjusted returns

- Evaluate multi-strategy approaches

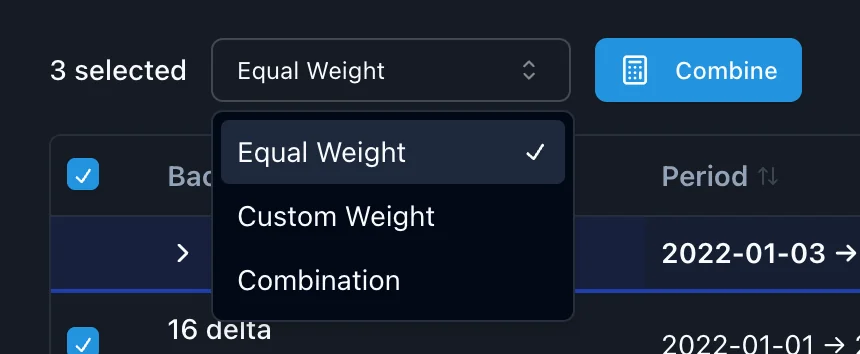

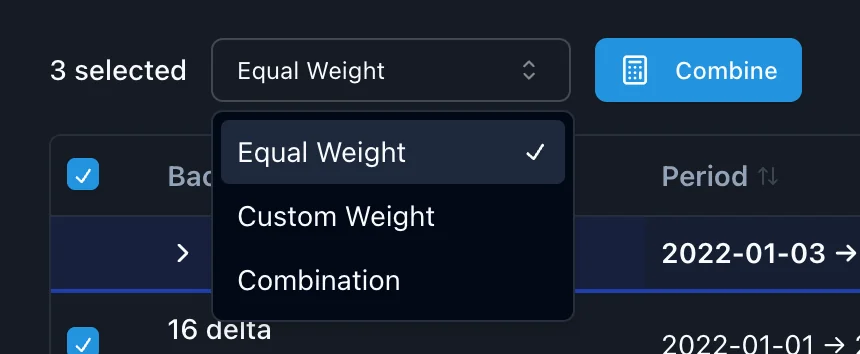

Combination Modes

1. Equal Weight (Standard Portfolio)

- All weights sum to exactly 1.0

- Example:

[0.5, 0.5] = 50% in each strategy

- Use for: Balanced diversification

2. Custom Weight (Flexible Allocation)

- Weights can sum to any value

- Example:

[0.7, 0.8] = 150% total (1.5x leverage)

- Use for: Risk-adjusted or leveraged portfolios

3. Combination (Parallel Strategies)

- Strategies run simultaneously at full or reduced scale

- Example:

[1.0, 1.0, 0] = Run first two at full scale

- Use for: Non-overlapping strategies (different times/conditions)

Creating a Portfolio

- Select Backtests: Check the strategies to include

- Choose Mode: Select combination mode

- Adjust Weights: Set weight for each strategy

- Combine: Click "Combine Portfolio"

- View Results: See combined equity curve and metrics

Portfolio Results

The combined portfolio shows:

- Combined equity curve - Portfolio performance over time

- Recalculated metrics - All metrics computed from combined returns

- Portfolio row - Highlighted in blue at top of comparison table

Common Questions

Q: Why can't I compare more than 10 backtests?

A: Performance and UI clarity. For more, run multiple comparisons.

Q: What if correlation matrix is empty?

A: Need 30+ overlapping days. Check date ranges align.

Q: Can I save a portfolio as a strategy?

A: Not directly. Clone individual strategies and note portfolio weights.

Q: Do weights have to sum to 1.0?

A: Only in "Equal Weight" mode. "Custom Weight" allows any total.

Q: Why are combined metrics different from averaging?

A: Metrics are recalculated from the combined equity curve for accuracy.

Q: How do I handle different date ranges?

A: System uses overlapping dates only. Non-overlapping days show zero contribution.

Next Steps