Loading ...

Loading ...

Analyze backtest results and understand performance metrics

After running a backtest, GreeksLab shows you how your strategy performed with charts, metrics, and detailed analysis.

The backtest results page has five tabs:

Shows your strategy's overall performance with key metrics and charts.

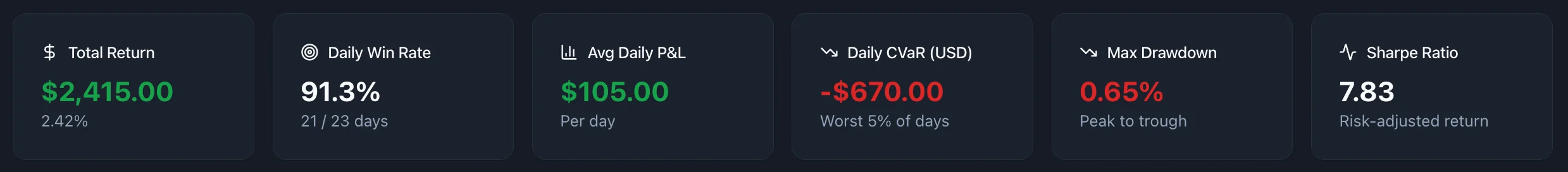

Six key performance indicators displayed at the top:

Performance Chart: Main equity curve showing account balance over time

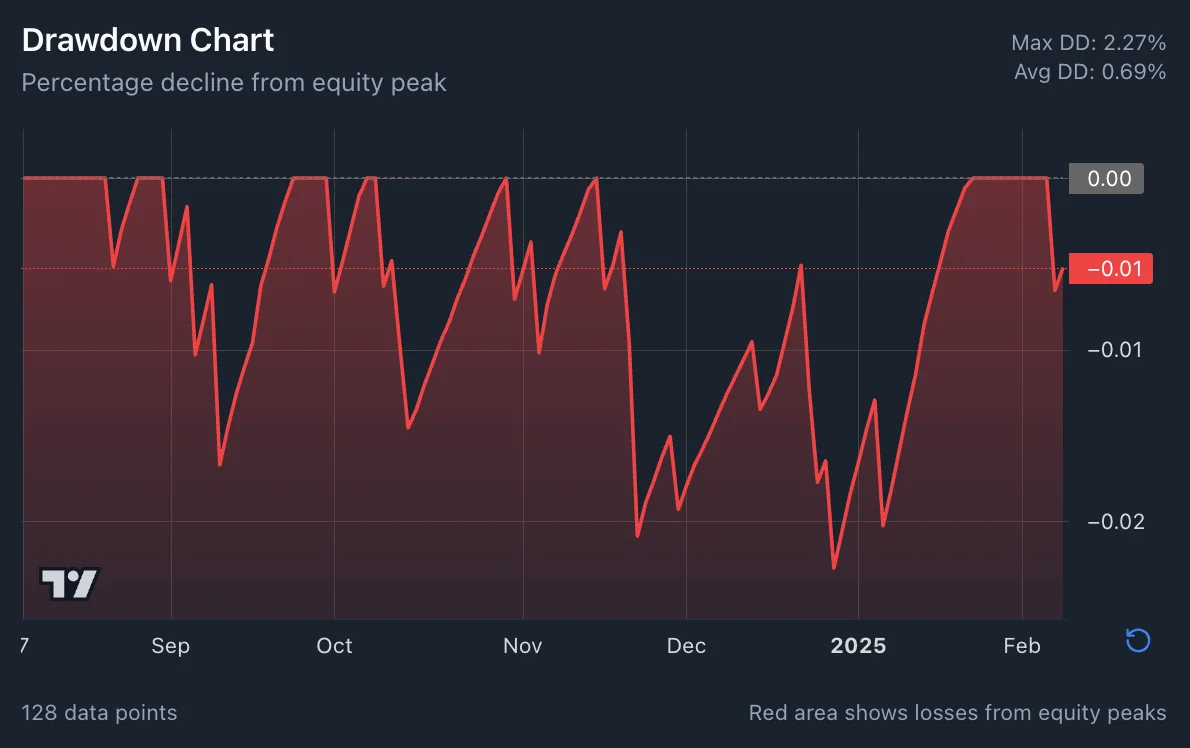

Drawdown Analysis: Shows depth and duration of losing periods

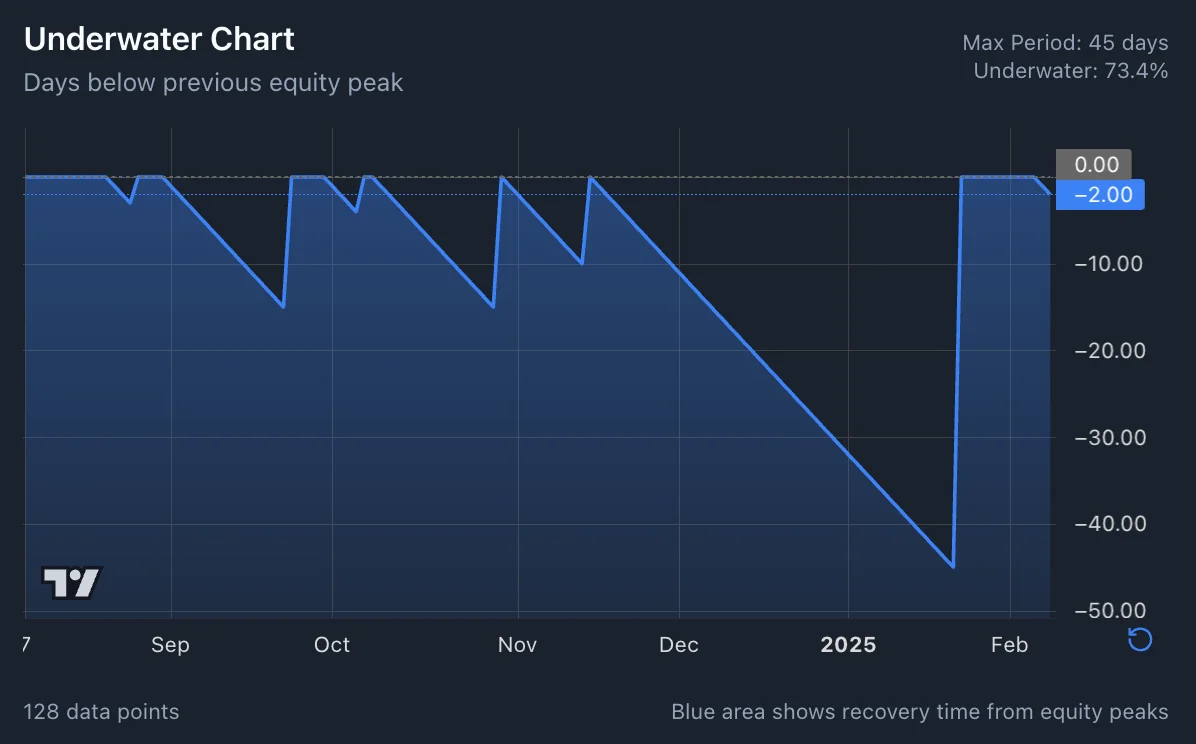

Underwater Analysis: Time spent below previous equity highs

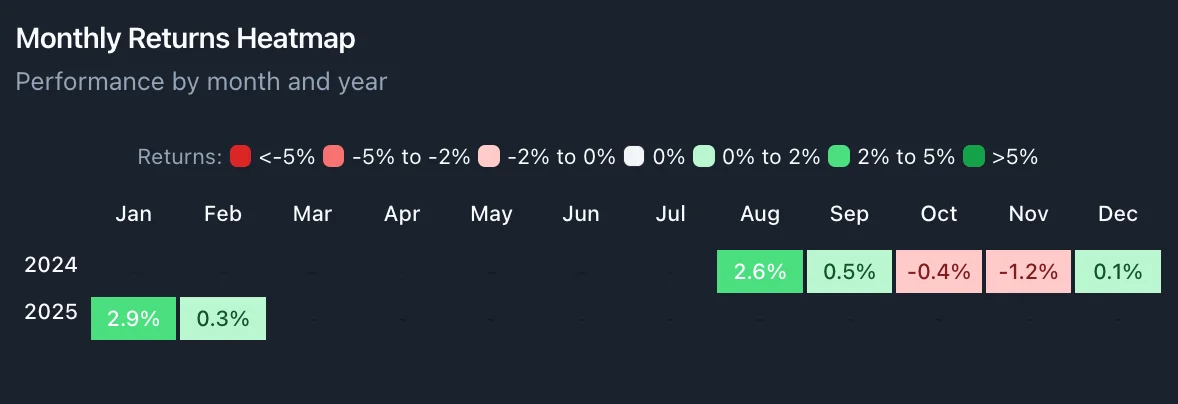

Monthly Returns Heatmap: Monthly performance with color coding

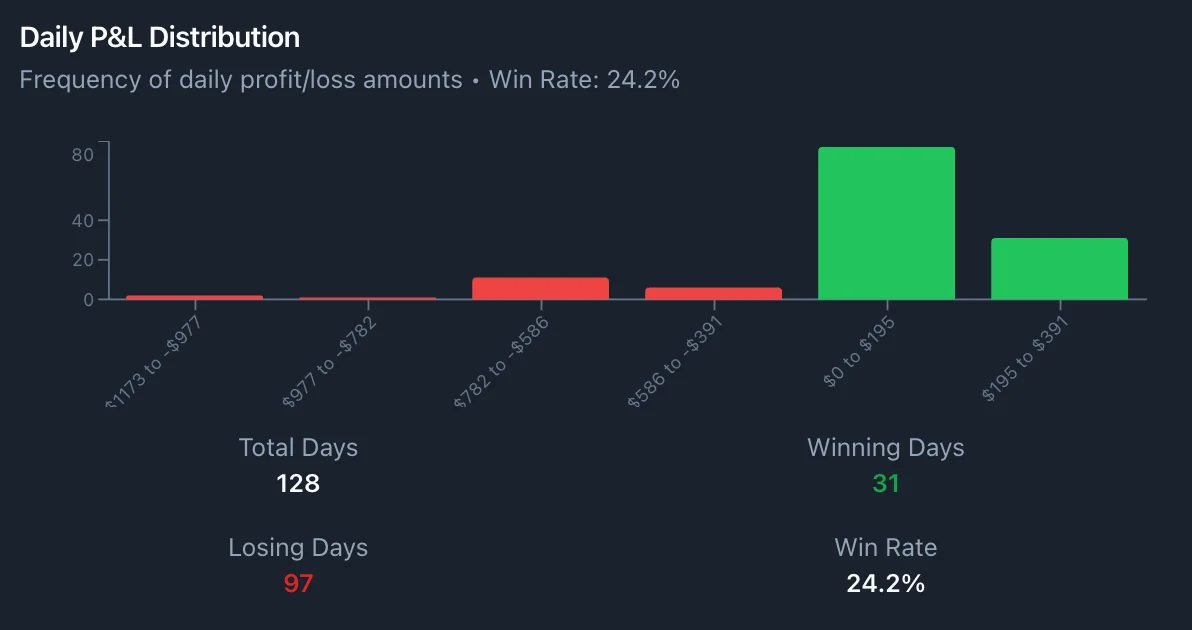

P&L Distribution: Frequency of different daily P&L outcomes

Below the charts, you'll find detailed performance metrics including return statistics, risk metrics, and trade statistics.

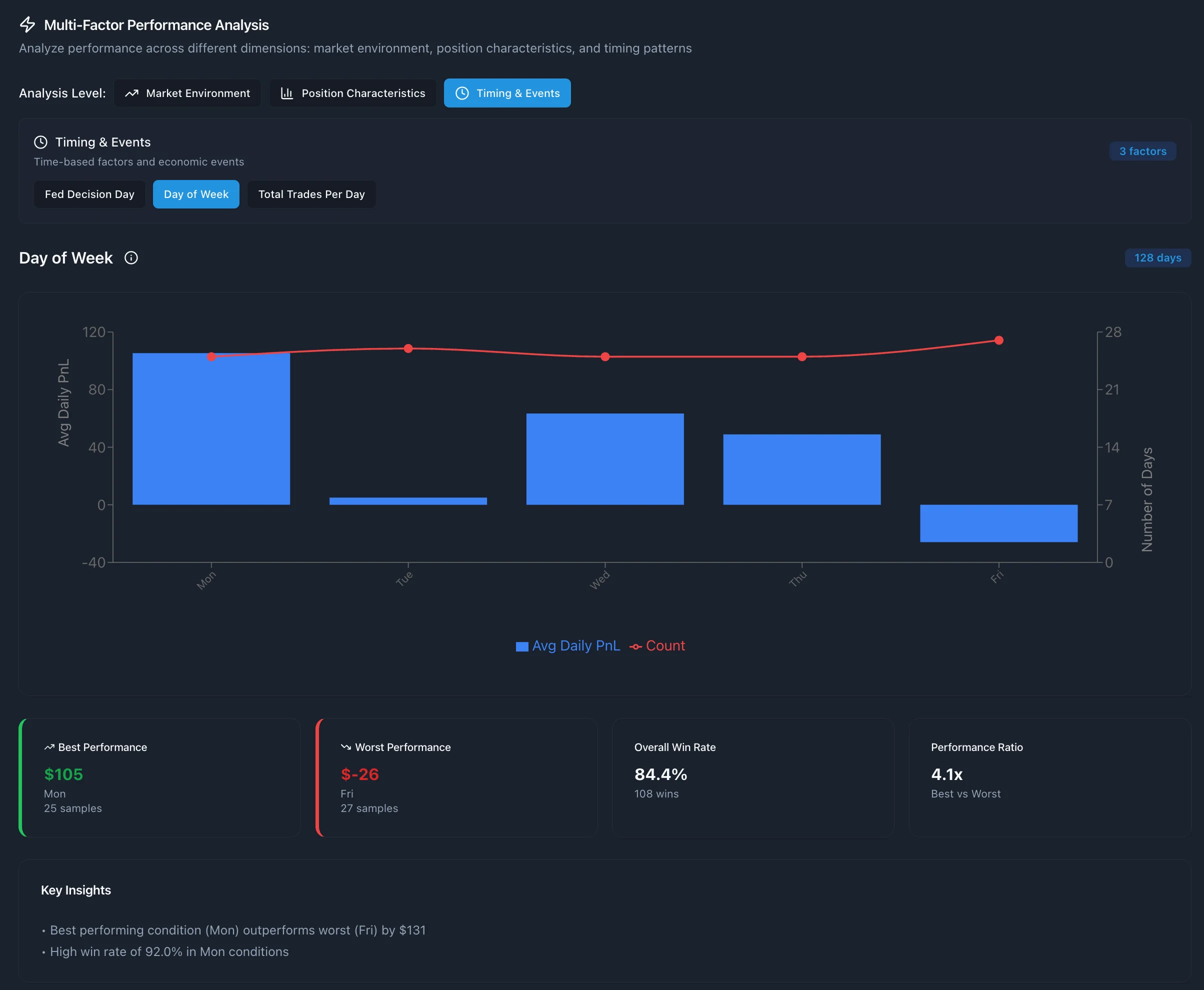

Analyzes your strategy's performance across different market conditions and factors.

Market Environment: VIX levels, overnight gaps, market movements

Time-Based: Entry hour, day of week, seasonality

Position Structure: DTE, premium levels, delta exposure

Position Templates: Performance by strategy template

Use the category tabs and factor selection to explore what drives your performance.

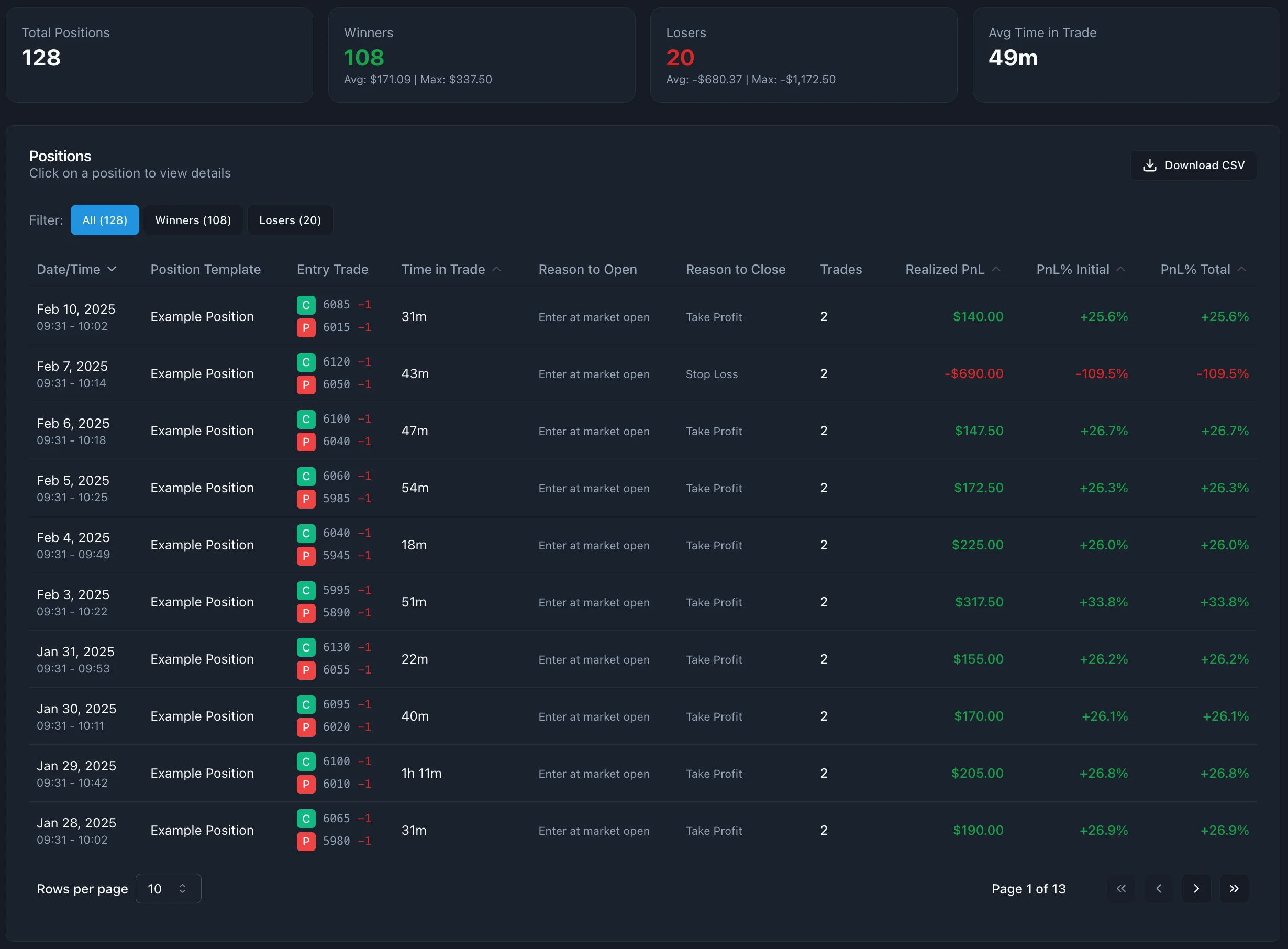

Shows every individual trade with detailed breakdowns:

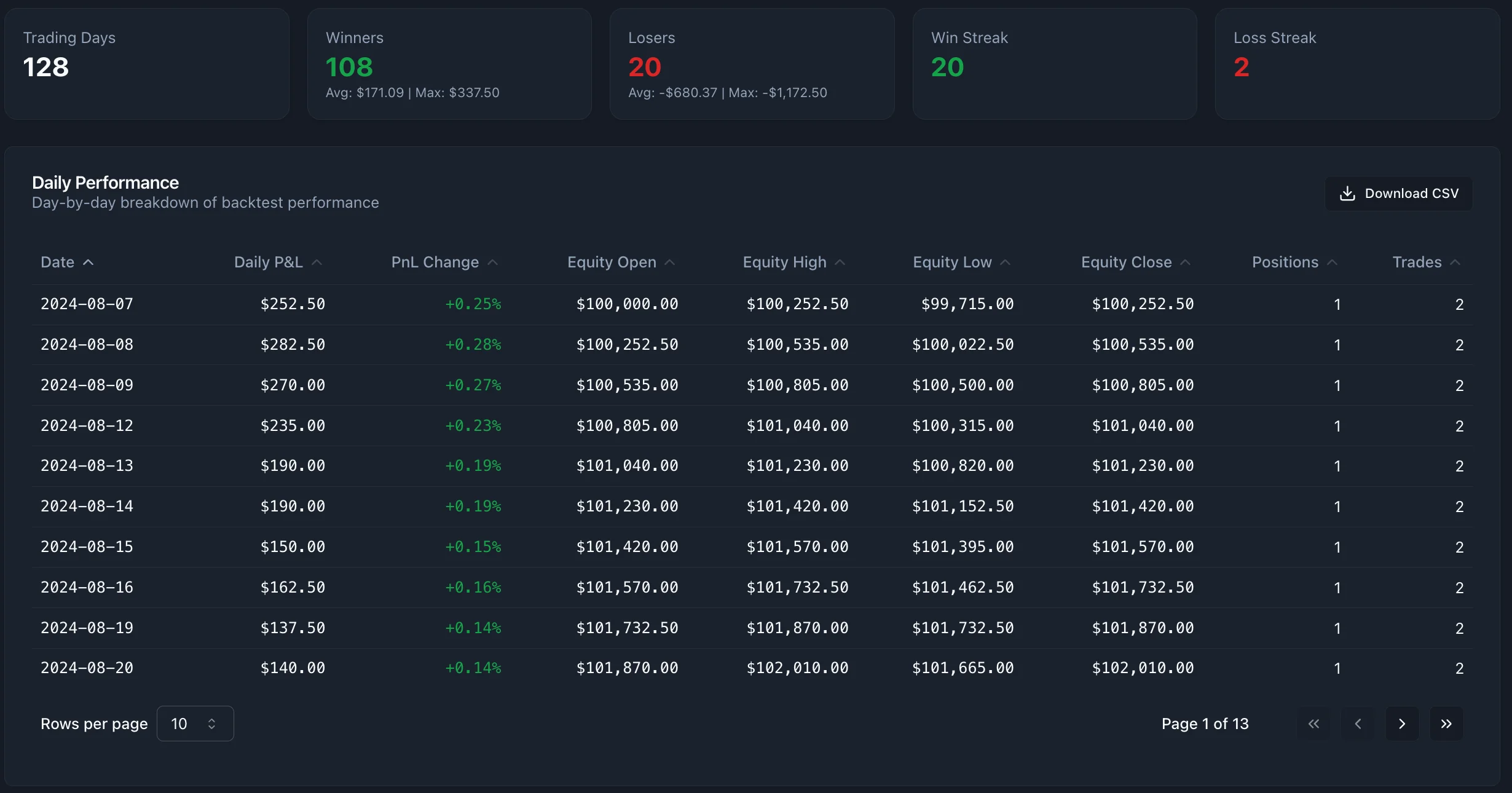

Day-by-day performance breakdown showing:

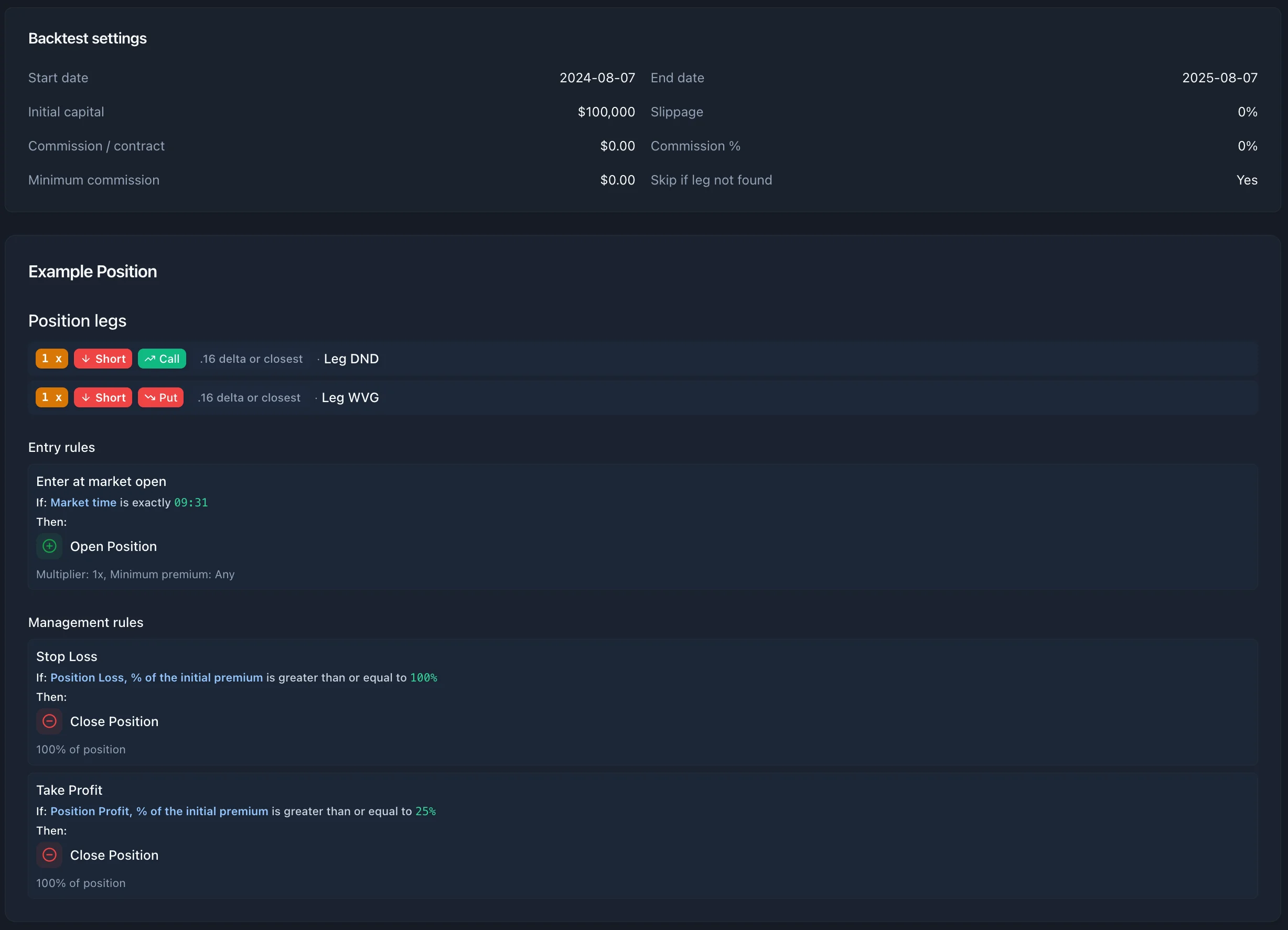

Shows a snapshot of your exact strategy configuration used for the backtest:

Now that you understand how to analyze backtest results, continue improving your trading strategies: