Loading ...

Loading ...

Define precise timing for position entry, profit-taking, and risk management

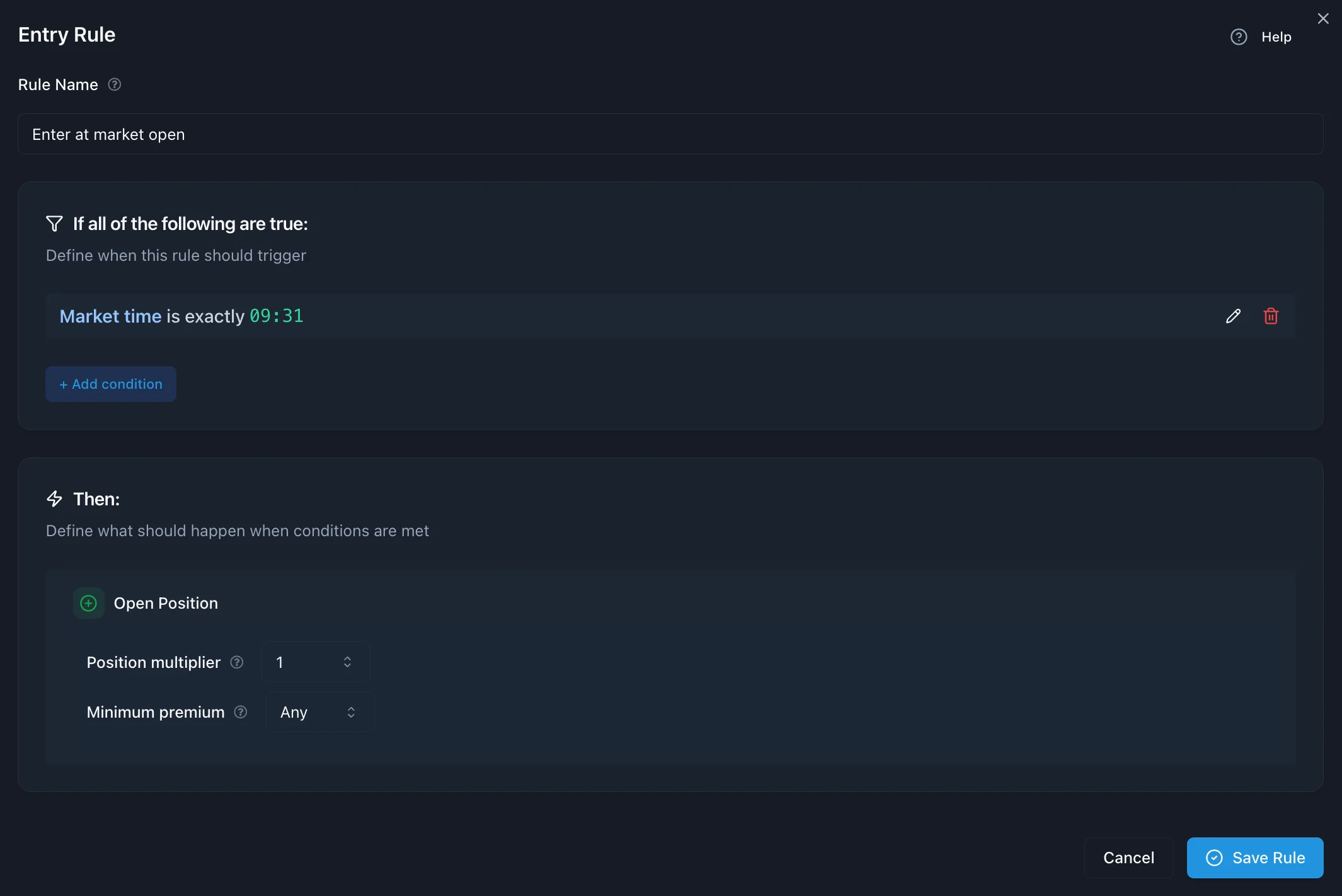

Rules are the core building blocks of your trading strategy in GreeksLab. A rule combines conditions (when something should happen) with an action (what should happen) to create automated trading logic.

A rule consists of two main components:

Rule Formula: IF (ALL conditions are true) THEN (execute action)

GreeksLab supports two main types of rules:

GreeksLab offers two ways to create conditions:

Actions define what happens when rule conditions are satisfied:

Rules are evaluated based on their conditions:

Ready to dive deeper? Explore these related topics:

Or return to the Strategy Building Guide to see how rules fit into the complete strategy framework.