Position Legs

Position legs define the specific option contracts that make up a trading position. Each leg is a component of a strategy — such as a short put or a long call — and is configured using flexible selection rules. Understanding how legs work is essential for building and testing effective options strategies in GreeksLab.

Leg Configuration Basics

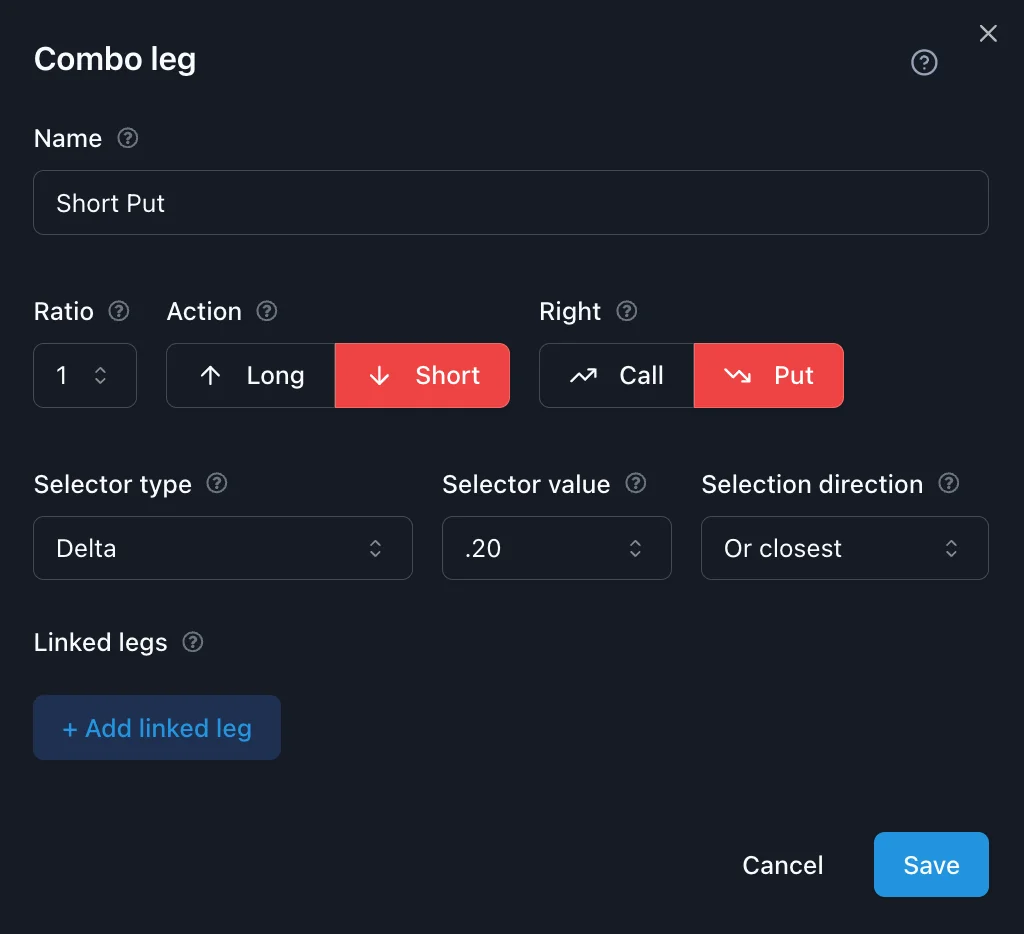

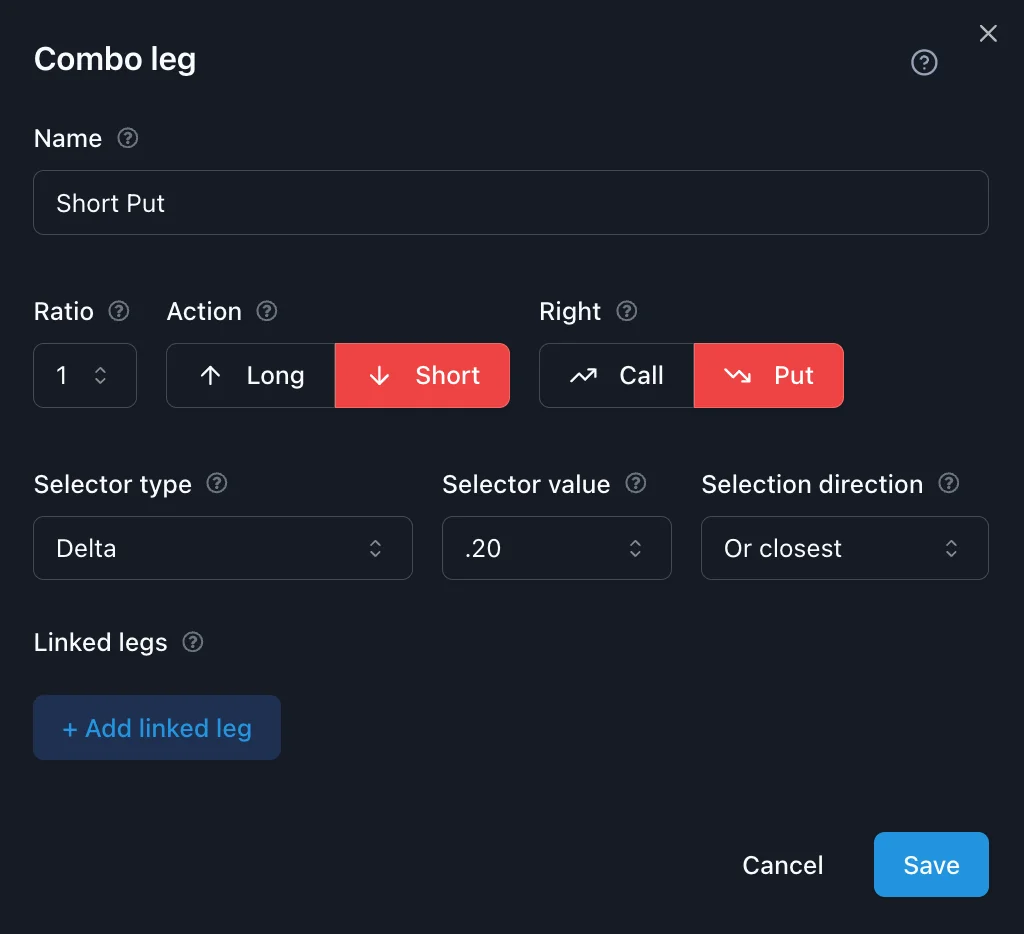

Each leg represents one option contract and includes the following key settings:

- Name: Descriptive label (e.g., "Short Put", "Long Call Protection")

- Option Type: Choose between call or put

- Action: Buy (Long) or sell (Short) the contract

- Ratio: Number of contracts, relative to other legs (e.g., 2 = trade 2 of this leg)

- Selector Type and Value: Determines how the option is chosen from the market

- Selection Direction: Fine-tunes how the option is picked

Selector Types

Selector types determine how each option leg is selected at entry. These are designed to make strategies flexible and adaptable.

1. Delta

Selects an option based on its delta — a common approach for systematic trading.

💡 Example:

- Short Put at .16 delta

- Long Call at .30 delta

⚠️ Important:In the strategy editor we always use absolute delta for selector value. That is if leg is long put, and delta is .10, during the simulation the engine will look for put option with -0.10 delta and buy it.

2. Strike Distance from ATM

Selects options a fixed number of strikes above or below the at-the-money level.

💡 Example:

- Sell a put 5 strikes below ATM

- Buy a call 3 strikes above ATM

3. % Out-of-the-Money (OTM)

Selects options based on how far out-of-the-money they are as a percentage.

💡 Example:

- Sell a put 2% OTM

- Sell a call 1.5% OTM

4. Fixed Premium

Selects options with a specific premium (price) target.

💡 Example:

- Sell a call with ~$250 premium

- Buy a put with ~$75 premium

Selection Direction

When multiple options match the criteria, this setting determines which one to pick:

- Closest: Pick the option closest to the target

- Closest Above: Pick the nearest option above the target

- Closest Below: Pick the nearest option below the target

Linked Legs

Linked legs allow one leg to be defined relative to another, such as building spreads or condors automatically.

Linked Selection Types

- Strike Distance from Another Option: Offset by number of strikes from another leg

- Delta Distance from Another Option: Offset by delta from another leg

💡 Example:

- Long put 5 strikes below a short put

- Long call with 0.10 less delta than a short call

Strategy Examples

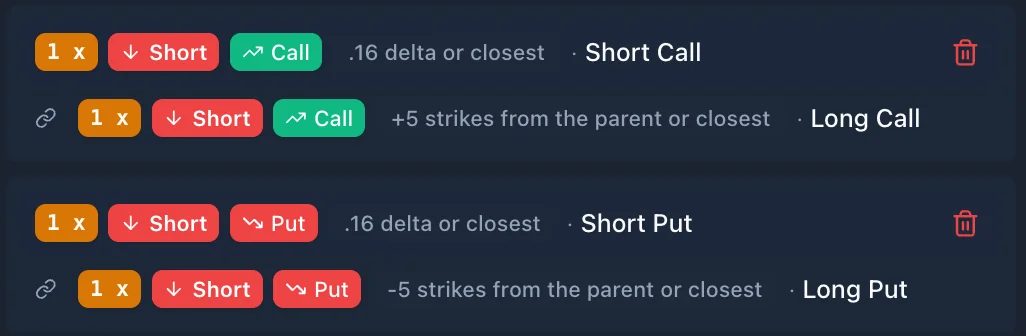

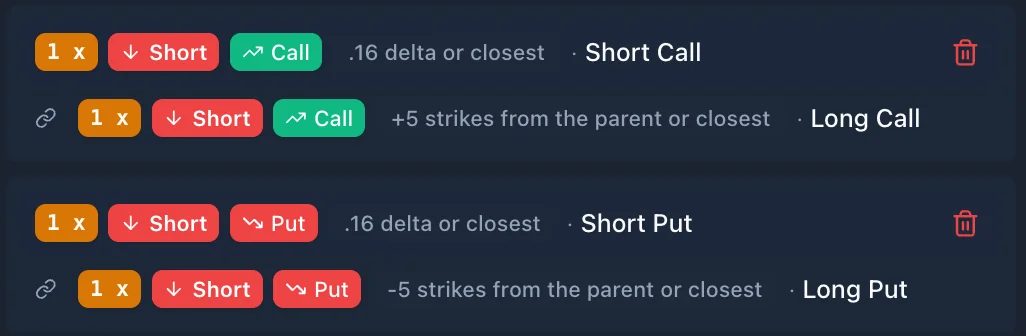

Iron Condor

- Short Put: .16 delta

- Long Put: Linked, 5 strikes lower

- Short Call: .16 delta

- Long Call: Linked, 5 strikes higher

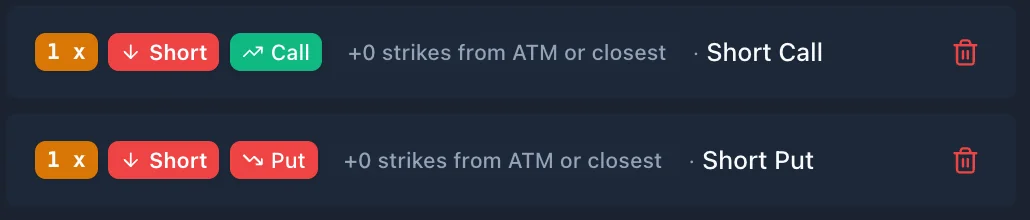

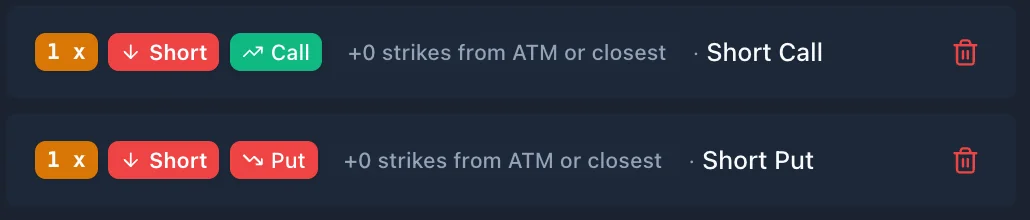

Short Straddle

- Short Call: At-the-money

- Short Put: At-the-money

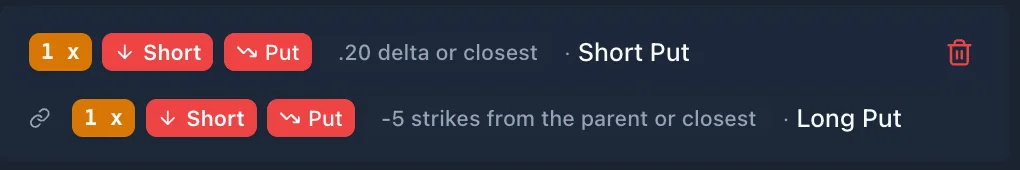

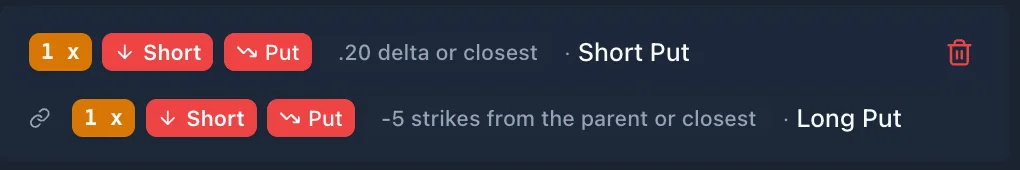

Bull Put Spread

- Short Put: .20 delta

- Long Put: Linked, 5 strikes lower

Best Practices

- Start simple: Begin with one or two legs before adding complexity

- Be consistent: Stick to one selector type (like delta) while testing

- Name clearly: Use leg names like “Short 16D Put” for clarity in results

- Use linked legs for spreads: Keep strike distances consistent automatically

Common Mistakes to Avoid

- Selector value too extreme: Values like 0.01 delta or 100 strikes from ATM may not find valid options

- Forgetting selection direction: Can result in unexpected contracts being selected

Next Steps

Now that position legs are clear, continue to: