Loading ...

Loading ...

Welcome to the GreeksLab blog! Here you can find all of our latest articles and updates.

Zero-Day-to-Expiration (0DTE) options trading has gained significant popularity among traders who seek quick, intraday profits. But when you’re trading with a smaller account, you need strategies that offer limited risk and high probability of success. This article will walk you through the top 0DTE strategies best suited for smaller accounts, including vertical spreads, iron condors, butterflies, and credit spreads. We’ll also cover essential risk management tips and why backtesting is crucial for long-term success.

Read more →

Introducing new platform features: Time in Trade condition, Trailing Stop, and Break-Even Stop, empowering traders with automated exits and advanced risk management tools.

Read more →

Discover the unique opportunities and risks of 0DTE options trading. Learn about its advantages, key strategies, and how tools like GreeksLab can enhance your performance through backtesting and automation.

Read more →

Learn how to align Delta, Theta, Vega, and Gamma with your trading strategies. Optimize profits and manage risks effectively with this comprehensive guide to options Greeks.

Read more →

Explore the newly released free Options Price Calculator, leveraging the Black-Scholes-Merton model for accurate call and put option premium analysis.

Read more →

Options trading offers incredible flexibility, allowing investors to craft strategies tailored to their market outlook. From buying a single option to constructing complex multi-option positions, options provide the tools to customize risk and reward profiles effectively. In this article, we will explore at-expiration diagrams, focusing on single-option strategies, and lay the groundwork for understanding advanced options trading.

Read more →

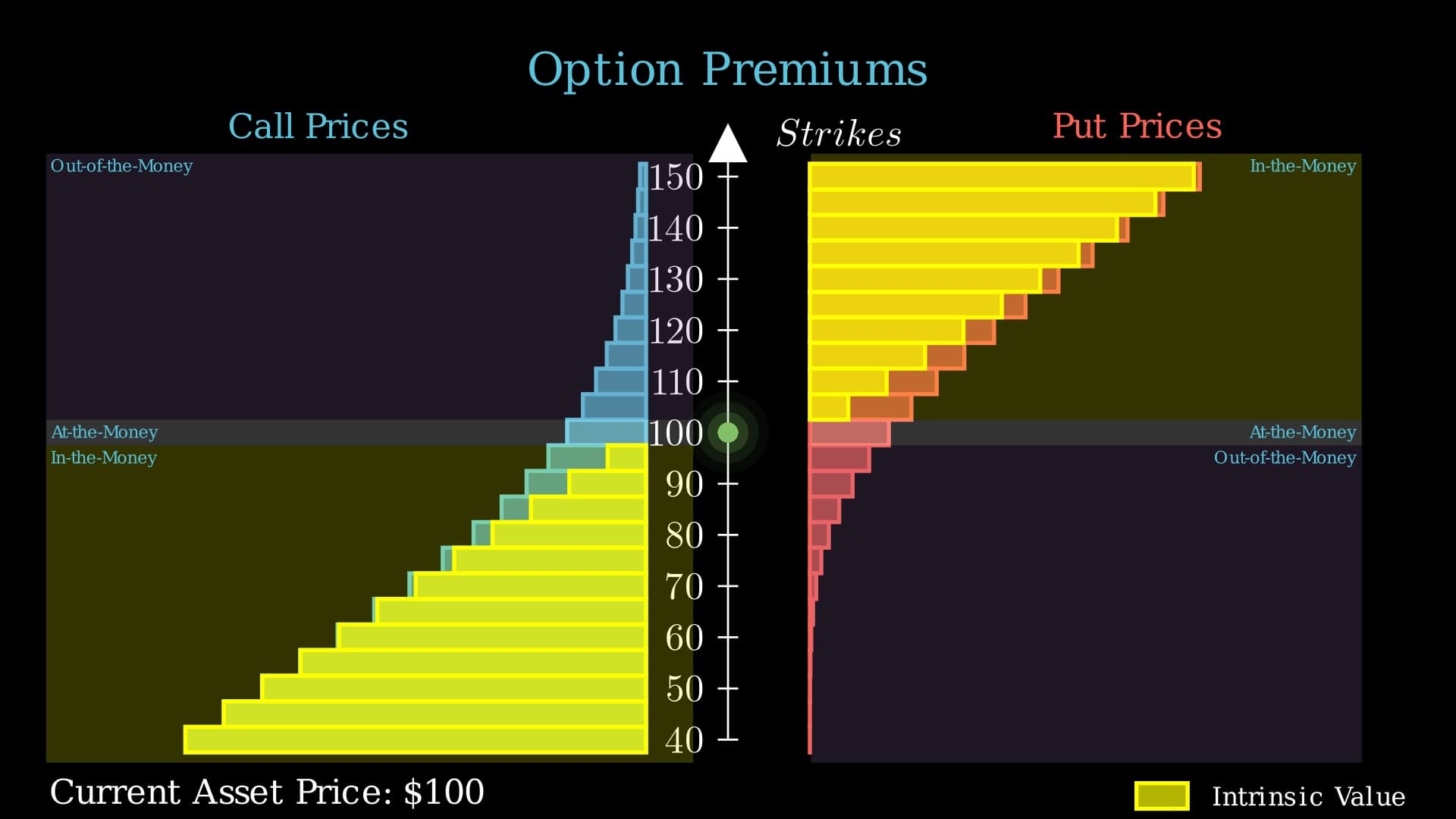

In options trading, one of the fundamental elements traders must understand is the relationship between the strike price and the current asset price. This relationship determines the option's "moneyness," influences the premium, and impacts both the intrinsic and time values of the option. For traders, particularly those dealing with high-stakes, short-term trades like Zero Days to Expiration (0DTE) options, understanding these relationships can mean the difference between profit and loss.

Read more →

Backtesting is crucial for options traders, particularly those engaged in high-risk, high-reward 0DTE strategies. This article explores why backtesting matters, highlighting its role in validating strategy effectiveness, identifying strengths and weaknesses, and managing risk. It provides a comprehensive guide on how to backtest options strategies, covering everything from defining your strategy and gathering historical data to executing the backtest and analyzing results. Emphasizing best practices and common pitfalls to avoid, the article equips traders with the knowledge to refine their strategies and improve trading performance without the need for coding or specialized platform features.

Read more →

In the high-stakes arena of zero days to expiration (0DTE) options trading, mastering risk management is crucial. This article explores advanced risk measures—Conditional Value at Risk (CVaR), Volatility of Returns, Max Drawdown, Sharpe Ratio, and others—that provide deeper insights into potential losses and strategy performance. By understanding and integrating these metrics into strategy development and backtesting, traders can optimize their 0DTE strategies.

Read more →

Implied volatility (IV) plays a critical role in the pricing and profitability of zero days to expiration (0DTE) options, as it reflects the market’s expectations of future price movement. Traders can predict changes in IV by monitoring news events, using volatility indicators like the VIX, analyzing volatility skew, and comparing historical and implied volatility. High IV inflates option premiums, creating opportunities to sell options, while low IV or expected volatility spikes make buying options more attractive. Strategies like selling premium in high-IV environments, buying options ahead of volatility increases, and using calendar spreads to capture IV crush can help traders maximize profits in 0DTE options trading.

Read more →