Loading ...

Loading ...

Welcome to the GreeksLab blog! Here you can find all of our latest articles and updates.

Compare 0DTE SPX backtests the right way: control variables, choose primary metrics and guardrails, slice by volatility regimes, use day-matched PnL, and stress slippage/commissions in GreeksLab.

Read more →

Volatility skew explained for SPX 0DTE: why puts price richer, how to measure it (RR25, BF25), and how to use skew for strike selection, wing sizing, and backtesting in GreeksLab.

Read more →

Learn how to trade 0DTE SPX options with a fully defined, rules-based approach. Covers entries, risk controls, backtesting, and validation.

Read more →

Learn how to backtest 0DTE SPX options strategies the right way. From using minute-level data to testing across market regimes, these best practices help you build realistic, risk-aware trading systems.

Read more →

Learn how to implement and backtest trailing stops for 0DTE options trading using GreeksLab's visual rule builder - no coding required. This comprehensive guide walks you through setting up dynamic exit strategies that protect profits while letting winners run, with step-by-step screenshots and performance optimization tips. Discover how trailing stops can improve your win rate by 10-30% and reduce emotional trading decisions in fast-moving zero-day expiration options markets.

Read more →

A practical, in-depth guide comparing SPX, SPY, and QQQ as underlyings for 0DTE (zero-days-to-expiration) options trading. Learn the key differences in liquidity, contract size, tax treatment, and assignment risk—so you can confidently choose the best product for your trading style and account size.

Read more →

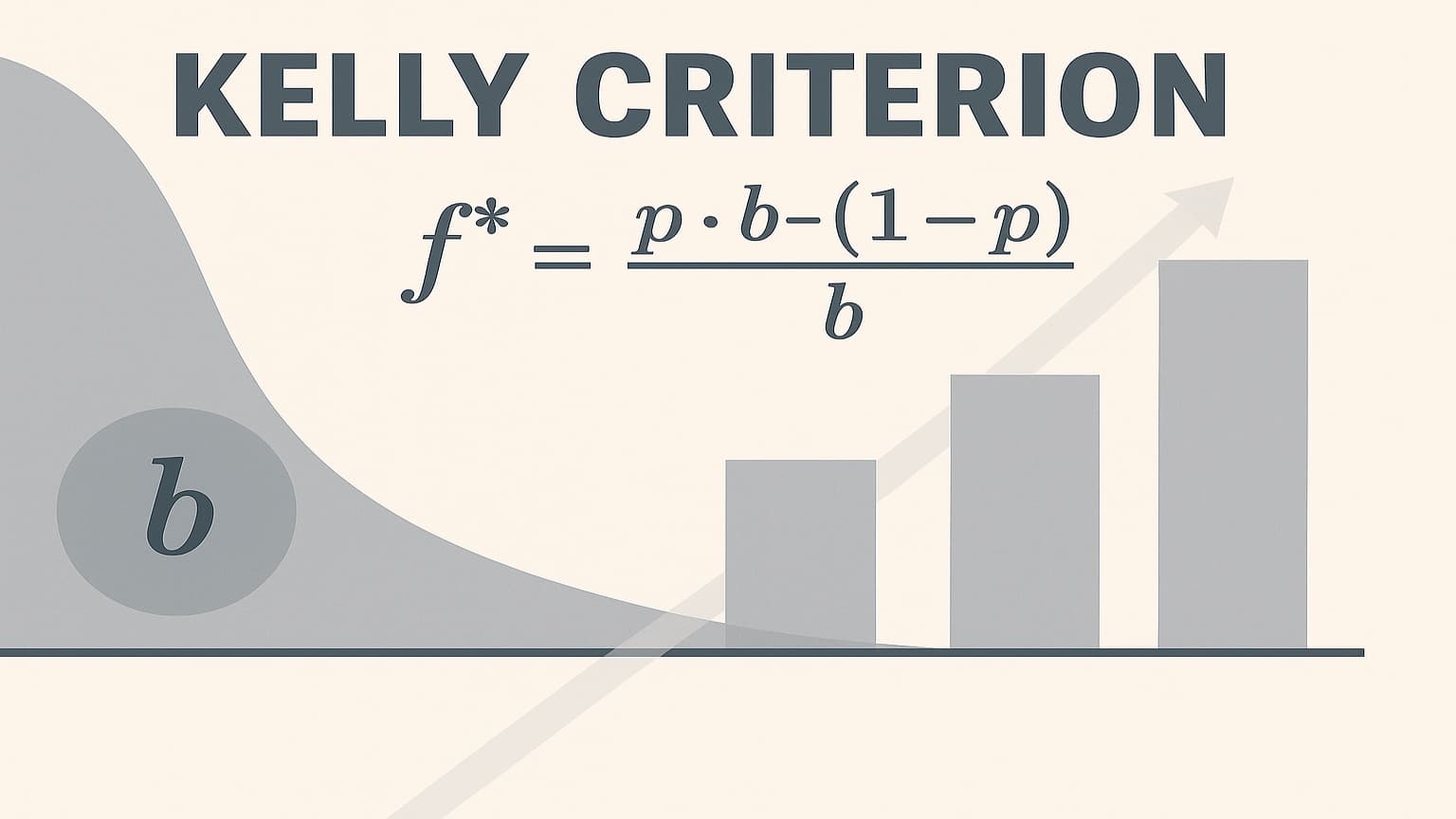

Learn how to optimize position sizing for 0DTE options using the Kelly Criterion. This guide covers payoff skews, volatility risks, strategy-specific applications, and practical adjustments like fractional sizing and stop-loss management.

Read more →

How to Trade 0DTE SPX Options for Daily Income A beginner-friendly guide to understanding 0DTE SPX options, including how they work, pros and cons, and how to backtest strategies using GreeksLab’s no-code platform.

Read more →

Learn how Position IV helps traders measure the implied volatility of multi-leg 0DTE SPX strategies, why it’s typically higher than VIX, and how to analyze it in GreeksLab.

Read more →